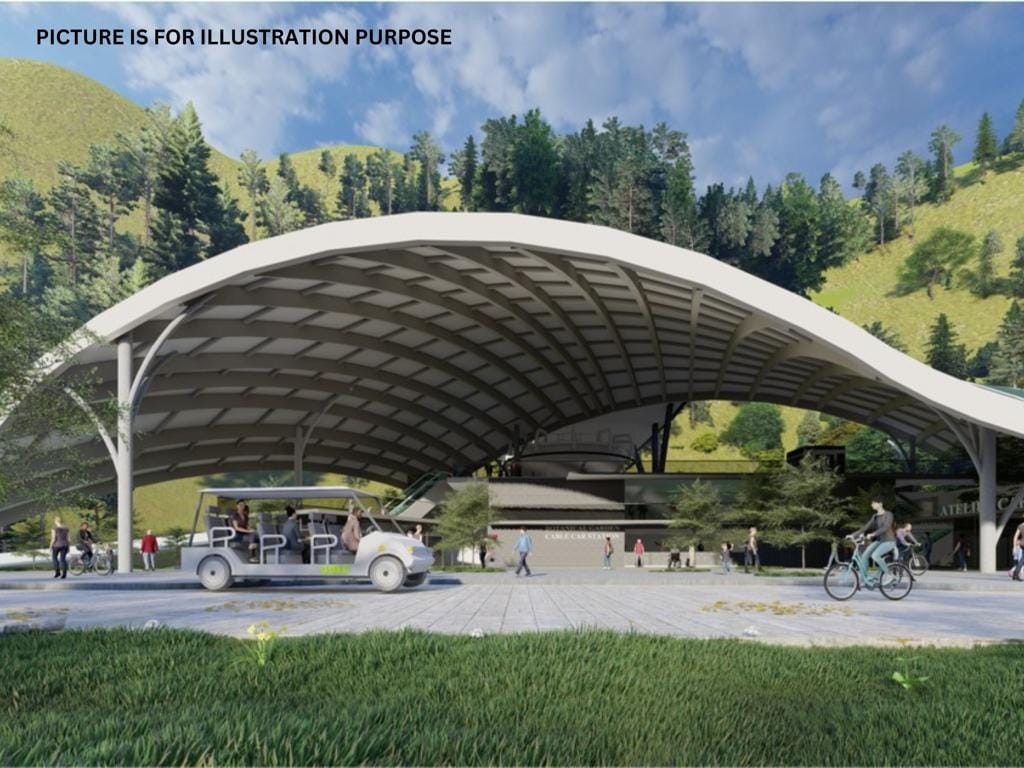

The Penang Hill cable car project is set to break ground in June and promises to elevate the tourist experience for the region, following the signing of a contract on Thursday.

Hartasuma Sdn Bhd, a leading Malaysian homegrown pioneer in the local rail industry with almost 30 years of experience, formally entered into a contract with Doppelmayr Seilbahnen GmbH, a global market leader in the field of ropeway engineering, for the much-anticipated Penang Hill cable car project.

Dopplemayr/Garaventa Group are also the manufacturers of the Penang Hill funicular system.

The signing ceremony took place at Doppelmayr’s headquarters in Wolfurt, Austria, on Thursday (April 25), and was signed by Michael Doppelmayr, chairman of the Board of Directors of Doppelmayr Holding SE and Tan Sri Ravindran Menon, group executive director of Hartasuma Sdn Bhd.

Present to witness the signing ceremony were key members of the Penang delegation, including state Infrastructure and Transport Committee chairman Zairil Khir Johari, state Tourism and Creative Economy Committee chairman Wong Hon Wai and other delegates.

The delegates also made technical visits to Doppelmayr, Garaventa and major component suppliers for the cable car system.

The cable car project was successfully awarded to Hartasuma through a Public-Private Partnership (PPP) on a Design, Finance, Build, Operate and Transfer basis, as announced on Dec 14, 2022, with Doppelmayr providing the cable car system.

Zairil said the groundbreaking is expected to commence in June.

“The Penang government is pleased with the milestones achieved and looks forward to the groundbreaking soon.

“This project will not only create another iconic tourist attraction and spur more economic activities but also solve many of the challenges confronting the funicular system and the Penang Botanic Gardens area,” said Zairil, who is also the co-chairman of the cable car project steering committee.

Meanwhile, Ravindran said the company shared congenial aspirations with the Penang government to create meaningful and distinctive tourism destinations within Penang.

“We also continue to reiterate our steadfast commitment towards the preservation of Penang Hill’s ecological environment and complete the cable car project on time,” he said.

The signing ceremony is a significant milestone for Penang, marking the first cable car in a biosphere reserve in Malaysia.

The Penang Hill cable car project, a highly anticipated venture, will enhance connectivity and accessibility to one of Malaysia’s most iconic and historical tourist destinations — a must-visit landmark for tourists in Penang.

With the combined expertise and commitment of Hartasuma, Doppelmayr, Penang state government and Penang Hill Corporation (PHC), the Penang Hill cable car project is poised to become a popular landmark for the region and serve as the gateway to the Penang Hill Biosphere Reserve.

With over 15,400 ropeway installations worldwide, the Doppelmayr Group has built more than 86 cable car installations located in UNESCO Heritage, Geopark and Biosphere sites as well as National Parks of various countries around the world.

Doppelmayr’s cable car systems are widely recognised for their reliability, safety and cutting-edge technology.

With Hartasuma and Doppelmayr’s involvement, PHC is confident that the cable car service on Penang Hill will meet the highest international standards.

Source: NST Online