Construction companies and property developers with exposure to Penang are set to benefit tremendously from the extensive development in the state.

According to TA Research, the Penang Transport Master Plan (PTMP) could be a strong growth catalyst for both the construction and property development sectors in the country.

With various projects in the pipeline, prospects for local players in both the construction and property development sectors appear promising, the brokerage firm wrote in its report, following a recent meeting with the Penang Development Corp.

“Given the mounting traffic congestion due to urbanisation and the influx of foreign investment, we believe that a well-planned holistic transport master plan should be implemented in the immediate future,” TA Research explained.

“Therefore, given the sheer size of the master plan, we are firmly convinced that PTMP will serve as a solid rerating catalyst for the construction sector,” it added.

As for the property development sector, TA Research said it expected PTMP would serve as a long-term catalyst, enhancing land value, stimulating economic activity, and driving housing demand in Penang.

“Property developers holding landbank in Penang Island stand to gain long term from the enhanced road and public transport connectivity under the PTMP,” it said.

“We are optimistic about Penang’s residential property market, driven by the robust recovery of the medical and tourism sectors on Penang Island post-pandemic, coupled with the thriving industrial sector on both Penang Island and the mainland,” it added.

TA Research maintained its “overweight” stance on the construction and property sectors, as well as Malaysian real estate investment trusts.

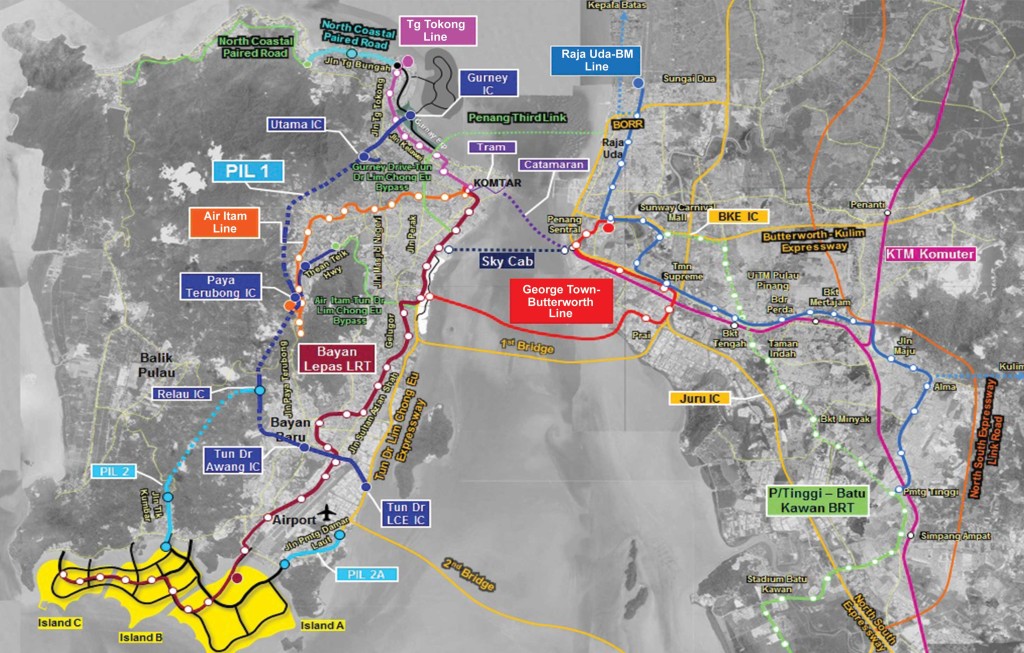

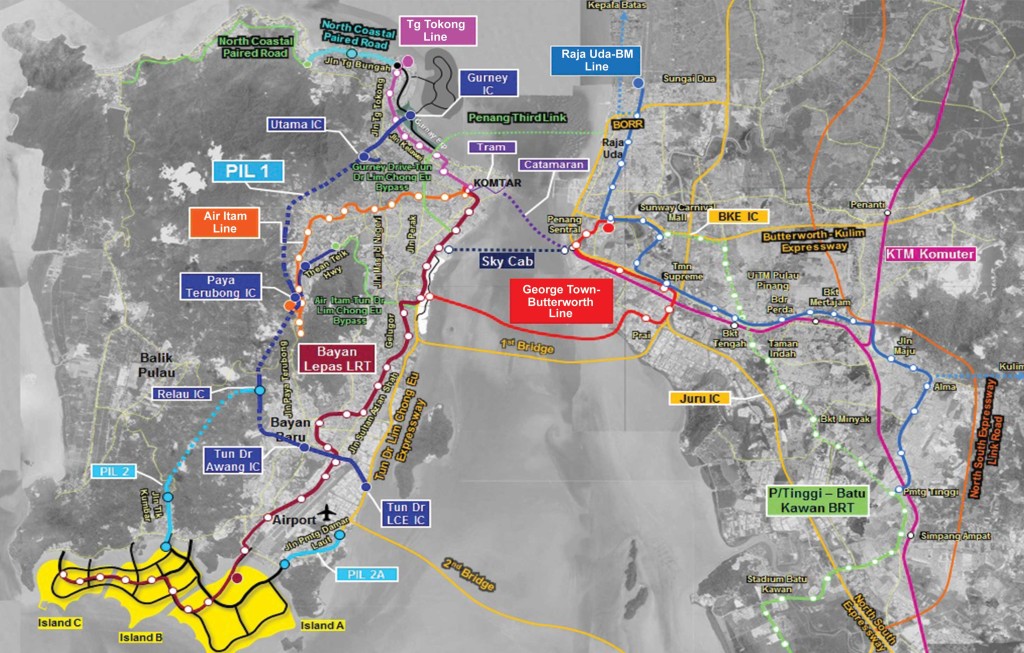

First mooted in 2009 to integrate modern transportation systems in Penang, the PTMP is expected to cost about RM46bil spread over several decades.

For the near-to-medium-term, the upcoming mega infrastructure project that is potentially being rolled out under PTMP is the Penang Light Rail Transit project, TA Research said, noting that it expected more development to kick in by the first half of 2024.

By companies in the construction sector, the brokerage said Gamuda Bhd is one of the primary beneficiaries of the PTMP, as the group has a sizeable exposure in Penang via SRS Consortium Sdn Bhd.

TA Research also liked Kerjaya Prospek Group Bhd due to its strong track record in Penang’s building sector and preferred contractor status for reclamation, infrastructure, and building projects on Andaman Island.

It said Kerjaya is well-positioned to benefit from growth in both Andaman Island and Bandar Cassia, thanks to its established relationships with Eastern & Oriental Bhd (E&O) and Aspen Group, respectively.

Other listed construction players that could potentially benefit from the PTMP included IJM Corp Bhd, WCT Holdings Bhd and Sunway Construction Group, which have strong expertise in railway-related jobs as well as civil works for township development.

For property developers, potential beneficiaries include E&O, Ideal Capital Bhd, IJM, Ivory Properties Group Bhd and Mah Sing Group Bhd.

To a lesser extent, Eco World Development Group Bhd, Paramount Corp Bhd, Tambun Indah Land Bhd and SP Setia Bhd, which have landbank in mainland Penang, could also reap benefits from the improved road and rail network.

Source: TheStar.com.my