Is the new 6-month loan moratorium suitable for everyone?

We can finally start applying for the six-month loan relief programme from banks which allows them to start making full payments again only in 2022.

But what do you need to know before deciding whether to take up the option?

If you are struggling with finances right now or expect to have difficulties paying your bank loans over the coming months this year, this six-month loan relief announced last month (June 28) under the Pemulih economic package may provide some temporary and near-instant financial relief.

But is this plan suitable for everyone?

Based on the FAQs and information published by several banks, here’s a quick summary of the main points you should know (on housing loans):

1. How does the loan payment assistance work?

Generally, you are given two options: a) A six-month moratorium on your loan, which means you will not pay for the installment of your house for six months and only resume the installment until after the six-month period ends; or b) A 50% reduction in monthly loan installments for six months.

2. Who can ask for the 6-month moratorium or 6-month half payment?

Individuals, SMEs and microenterprises can apply from July 7 through their respective banks to “opt-in” for either six-month moratorium or halved monthly installments. Your application will be automatically approved, without you needing to provide any supporting documents.

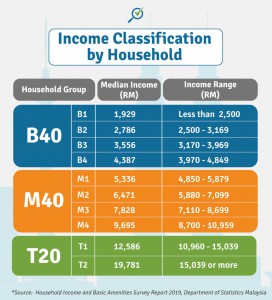

This is open to all individuals from all income brackets — B40 low-income category, M40 mid-income category or T20 high-income category.

3. Who is not eligible for the 6-month moratorium or 6-month half payment?

This repayment assistance is not open to borrowers who have been overdue in their payments for more than 90 days (which would mean owing payments for more than three months), or those undergoing bankruptcy or winding-up proceedings.

Loans approved after the six-month loan relief is announced will not be eligible for repayment assistance. You may want to check with your bank for additional details on the cutoff date.

4. The cost (or after-effect) of the loan moratorium

Before applying for the 6-month loan moratorium or 6-month halved monthly installments, you should bear in mind that interest will continue to be charged and accumulated, and your loan tenure or repayment period may get extended. However, there will be no compounding interest (interest on interest) during the six months.

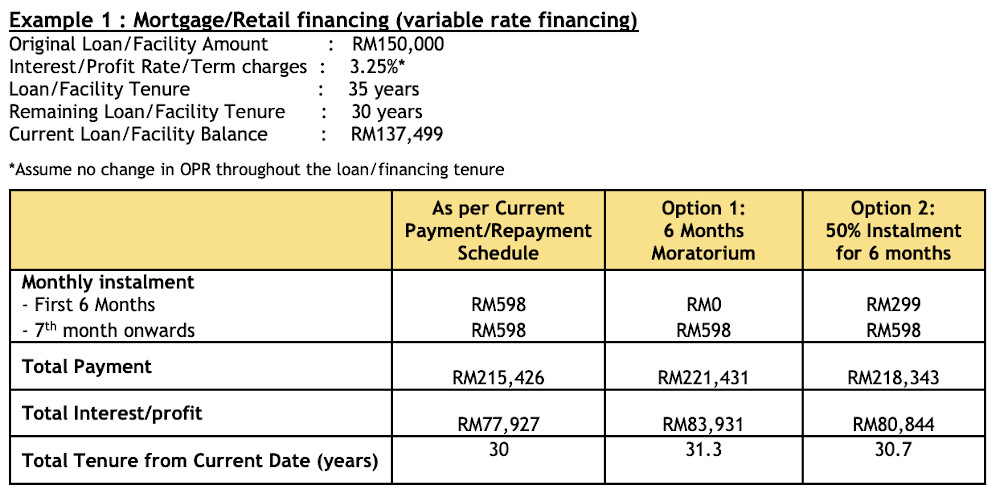

Below is an illustration by Maybank on how the loan you took will become more costly as a whole,

In this example, the borrower has a remaining balance of RM137,499 to repay over the next 30 years.

Instead of paying interest of RM77,927 over 30 years with full monthly installment payments of RM598 in this example, a borrower will have eventually paid RM83,931 in interest (or about RM6,000 more) if no payment was made for six months using the moratorium option and if payments of RM598 were resumed from the seventh month onwards, with the loan to be fully-cleared 31.3 years later instead of 30 years.

If the borrower only paid half of the monthly instalments for six months before resuming full RM598 instalment payments, the additional interest of about RM2,970 accumulated will result in an eventual interest cost of RM80,897 paid over 30.7 years.

5. So should you ask for the loan moratorium or halved payments for six months?

If you are facing financial difficulties and need temporary relief until your financial situation improves, you can opt-in, after having read and understood all the necessary information such as the FAQ and terms and conditions. If you are unsure and need guidance or want to explore alternatives, you can consult AKPK which gives free advice.

Borrowers who can afford to continue their loan repayments should do so, as this would be in their best interest as resuming repayments would reduce the overall cost of borrowings.

Conclusion

If you are not sure where to start, visit Bank Negara Malaysia’s website where it lists the links to individual banks’ websites for details on repayment assistance plans. Or contact AKPK for free advice.