More national housing affordability initiatives needed

While Malaysians are satisfied overall with government approaches to bring affordable property to the people, the majority still feel that a more targeted approach could be taken to address this pressing gap in the property market, according to the PropertyGuru Consumer Sentiment Survey H2 2018.

While Malaysians are satisfied overall with government approaches to bring affordable property to the people, the majority still feel that a more targeted approach could be taken to address this pressing gap in the property market, according to the PropertyGuru Consumer Sentiment Survey H2 2018.

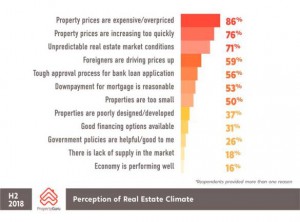

The sentiment comes amid widespread perceptions that property prices remain high in the country, with unfavourable market timing, and lack of capital and good financial options also cited as challenges by property seekers.

PropertyGuru Malaysia country manager Sheldon Fernandez said in 1Q 2013, 93% of participants in the PropertyGuru Consumer Sentiment Survey expressed dissatisfaction with housing initiatives available at the time.

“This has decreased to 63% in the recent H2 2018 survey, with satisfaction rising from 7% to 22% over a similar timeframe. These movements reflect increasing confidence in public sector initiatives over the past few years, with Malaysians wanting the government to up the ante in their initiatives to provide more affordable national housing for the masses,” said Fernandez in a statement.

According to the survey, actual uptake of national affordable housing programmes is low, despite demand for such initiatives. Only 19% of survey participants applied for the 1Malaysia People’s Housing (PR1MA) scheme, for example.

Participation rates ranged from 4%–9% for other initiatives such as Rumah Selangorku, the Federal Territories Affordable Housing Project, My First Home Scheme, 1Malaysia Civil Servants Housing and MyHome.

In fact, 41% of respondents reflected that they were not qualified to apply for such national housing initiatives.

“A large segment of home seekers is either not qualified, or unaware about existing affordable housing initiatives. That has deterred them from applying for or even considering these options.

“Another challenge is the lack of consensus on what exactly constitutes affordable housing itself. Baseline prices vary from location to location. That being said, the majority (nearly eight out of 10) of respondents considered properties in the RM300,000 to RM500,000 range to be on the affordable spectrum,” added Fernandez.

At the heart of the affordability debate are property prices which have rocketed skywards in recent years, with 76% of Malaysians anticipating continued price increases in the next six months, indicating prevailing negative price sentiment in the market.

Regardless of price movements, household income in Malaysia has failed to rise commensurate with costs. This has caused many to cite unfavourable timing and market conditions as a factor in their property decisions.

“Our survey found that more than half (51%) of respondents had resorted to withdrawing their Employees Provident Fund savings at least once to purchase properties. 67% of Malaysians have a budget of RM500,000 or less for property purchases,” said Fernandez.

This is supported by recent Bank Negara Malaysia reports, which found that 61% of loans approved in 2018 were undertaken for properties below RM500,000. In total, banks distributed RM133 billion in home financing to some 350,000 borrowers during that year.

Given income stagnation in the country, the younger generation has been particularly hard hit by property financing issues. More than 70% of home seekers under 29 years of age, for example, see prevailing interest rates in Malaysia as excessively high.

Further challenges for home buyers seeking financing include unfamiliarity with the paperwork involved, unfavourable credit histories, unstable sources of income and other outstanding debts that contribute towards high debt-service ratios in the country, such as car loans, personal loans and outstanding credit card debts.

To address loan rejections, PropertyGuru recently introduced Home Loan Pre-Approval to increase their chances of getting a loan. It empowers home seekers to know for sure how much they can borrow from their bank, even before they apply for a loan. Once they know their qualified loan amount, which is 99.9% accurate, they are immediately matched with homes they are pre-approved for, giving them instant access to preferential rates by bank partners.

“Looking at the bigger picture in terms of market appetite, we continue to see Johor, Penang, Kuala Lumpur and Selangor as primary contributors to transactions in 2018, with 75% of loans approved undertaken for properties in these areas,” said Fernandez.

Asking prices generally trended downwards or sideways in Q1 2019, as the market adjusts to larger economic tides. However, the Johor, Penang and Kuala Lumpur markets registered marginal quarter-on-quarter increases of up to 0.5%, in line with their role as key focuses of national development.

Source: TheSunDaily.my