Cut prices please, Mr. Developer? Well…

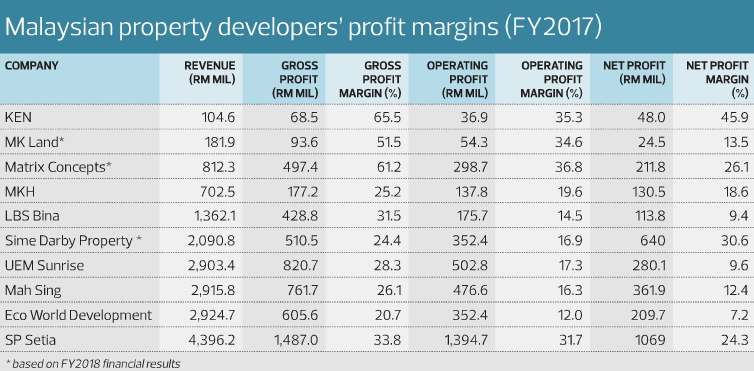

This is an interesting view from a property industry observer about the property prices here in Malaysia. The full article is in edgeprop.my (Titled: Developers must cut profits to lower property prices). Basically, in order to reduce the price of properties, the developers must cut their profit margins. “This is the only component of development costs that a developer can control,” they told The Edge Malaysia. The reasoning is that many public-listed property developers are currently enjoying FAT profit margins exceeding even 20 percent. One example given was that of KEN Holdings Bhd with a net profit margin of 45.86% in its financial year ended Dec 31, 2017 (FY17) and 47% in the first half of its FY18. It showed a net profit that almost doubled from 29.9% in FY16 due to the completion of KEN Rimba Condominium 1 in the KEN Rimba township in Seksyen 16, Shah Alam.

Article also quoted the recent news about our Finance Minister Lim Guan Eng who had urged developers to lower property prices as the Sales and Service Tax as exemptions from the tax on certain building services and materials are expected to reduce property development costs, failing which the waiver may be reviewed. Earlier article here: SST exemption may not be permanent, IF Analysts however expect the exemption to only result in 3% cost savings.This is an amount which is insufficient to rectify the current imbalances in the property market. “Developers are looking at cost savings of 1% to 3% from the tax exemption as some of the items are now taxed at a higher rate than under the previous tax system while others are exempted.” “It [affordability of homes] is a structural issue that cannot be solved just by giving tax exemptions on construction,” said an analyst at a local investment bank who covers property development companies. Full article in Edgeprop.my.

Image shows some latest numbers from listed developers in Malaysia. Generally the profit margins are in double digits except for a few developers. I personally do not think the profit margin on an overall basis is a good gauge on whether the property developers should reduce prices. As a buyer, of course I would prefer the developers to reduce their prices but let’s understand that the profit margins stated are not based on a project by project basis but more of a period under review. It may also not be a good reflection unless the developer is only a pure developer and has just one project and has no other businesses. Perhaps someone could study what’s the actual profit margin by project basis for a much clearer understanding instead? A high density affordable project for example may have a lower profit margin per unit but may still be contributing a substantial number to the company while one smaller project may have a higher profit margin but this does not mean it can cover the losses from other less popular projects for example. Hopefully more good news for the market will be coming soon.

Charles Tan – the founder of kopiandproperty.com. He is popular for sharing his thought on property investment mostly based on his own 15 years experience as well as from all the readings and conversations with property gurus in the industry. (Source)

Just give a allowable 20% net profit and limit top executive salary to certain amount. Everything above is taxed at above 50%.