Ensuring affordable homes for Penang folk

As main cities in the country continue to urbanize, the provision of affordable homes remains a major concern. Penang is no exception.

Currently with a population of 1.66 million, Penang is one of the most populous states in the country and remains a highly desired location for property growth and investment. With half its population concentrated on the 293 sq km Penang Island, the state will only get more crowded as the Department of Statistics Malaysia has forecast the population to increase to 1.86 million by 2030.

To address population growth in Penang, the state government, through the Penang Development Corporation, has made the provision of affordable housing a priority, with the launch of its affordable housing scheme in February 2013. The scheme has 14 projects in all five districts in the state, with 26,255 affordable homes on offer.

“The state government is allocating RM500 million to provide affordable housing under this scheme,” state executive councillor for housing, town and country planning Jagdeep Singh Deo says in an email interview.

He notes that the state’s current household size of 3.98 will require an additional 22,613 homes by 2020 and another 27,638 by 2030.

At present, works under the affordable housing scheme have commenced for projects in Teluk Kumbar (Daerah Barat Daya), Kampung Jawa (Seberang Perai Utara) and Phase 1 of Bandar Cassia in Batu Kawan (Seberang Perai Selatan).

Phase 1 of Bandar Cassia, which has 520 homes, will be the first project to be completed in December this year. The entire Bandar Cassia development is slated to complete in the next 10 to 15 years.

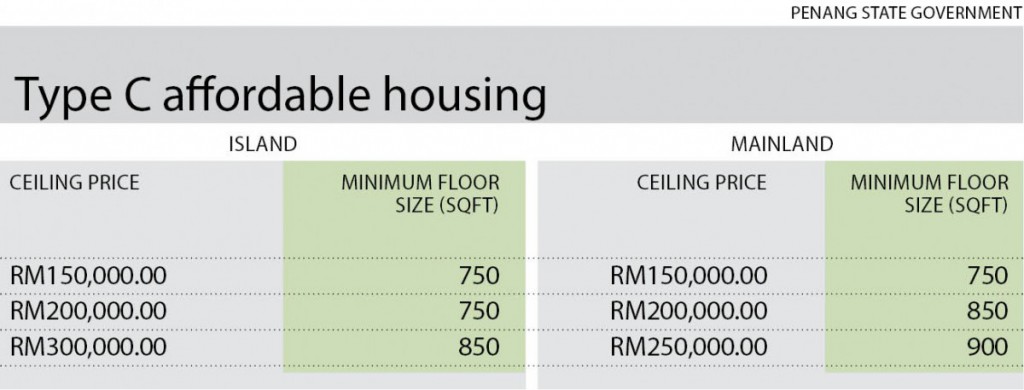

The types of affordable housing range from Type A (formerly known as low cost) to Type B (low-medium cost) and Type C (units costing RM150,000 to RM300,000).

Types A and B units have a minimum floor size of 650 sq ft and are priced at RM42,000 and RM72,500 respectively. Type C homes come with a minimum floor size of 750 sq ft, and are capped at RM300,000 on the island and RM250,000 on the mainland.

To meet the projected 50,251 homes required by 2030, the state government has embarked on public-private partnerships. Private sector developers will contribute an equal number of affordable homes as the state government to ensure there are sufficient houses to cater for the growing population.

“With the introduction of the 100% affordable housing guidelines in August 2014, the participation of the private sector has been overwhelming. This clearly shows there is a large market for such a category of housing,” says Jagdeep.

To date, the state government has approved applications by the private sector to build some 11,550 homes in accordance with the guidelines.

Ongoing affordable housing projects by the private sector are Tri-Pinnacle by Aspen Group, Ramah Pavilion by M Summit Group, One Foresta and I-Santorini by Ideal Property Group and Granito by BSG Group.

To encourage private sector participation, Jagdeep says the state government has agreed to reduce the compliance costs.

“The state has offered to waive the compliance component which requires 30% of homes built by the private sector to be priced less than RM72,500,” he adds.

“A reduction has also been offered on development charges. For regular housing developments, such charges are RM15 psf, whereas those stated in the guidelines are only RM5 psf,” he adds.

Jagdeep says the state government welcomes applications under the 1Malaysia People’s Housing (PR1MA) programme. PR1MA Corporation Malaysia had submitted several applications in December 2015 and three applications have been approved to date, namely for 2,387 homes in Tasek Gelugor, 905 in Bukit Gelugor and 1,450 in Batu Feringghi.

However, he adds that PR1MA has withdrawn its application to build 29 blocks of 23 to 27-storeys in Kuala Sungai Pinang, Balik Pulau, in April this year. The blocks consist of 9,904 housing units priced up to RM510,000.

Jagdeep says that PR1MA withdrew its application on the advice of the state government as Balik Pulau has a 16-storey height limit for buildings and under the guidelines, affordable units on the island have a price limit of not more than RM300,000.

“Just like all other applications for developments, the guidelines relating to affordable housing must be complied with,” he says.

“Nonetheless, the state government will duly process such applications expeditiously and hopes that PR1MA will continue to submit them for more affordable housing projects in Penang,” he adds.

To prevent applicants from abusing the affordable housing system, Jagdeep says the state government is consolidating the procedure to take legal action against those who rent out Type A and Type B homes, which are supposed to be owner-occupied. “We now require applicants to execute a statutory declaration that gives us the right to repossess the unit if it is rented out.”

Jagdeep, who also chairs the nine-member selection process enhancement committee, says the stringent vetting process will ensure only those who are truly eligible will be selected.

Besides submitting their central credit reference information system (CCRIS) record, applicants are also required to attend several sessions with the credit counselling and debt management agency (AKPK) to iron out issues related to housing loans.

Additionally, owners of Types A and B homes are not allowed to sell their properties for 10 years. Owners of Type C housing costing RM150,000 to RM300,000 cannot sell them for five years.

The state government is also addressing the problem of high loan rejection rates. “Getting a loan is the biggest hurdle,” Jagdeep says.

“For example, one of the projects in Bandar Cassia has 520 homes. We submitted 800 eligible names, but only 200 signed the sales and purchase agreement because the rest were unable to obtain a bank loan.

“Bank Negara Malaysia needs to address this problem. If we do not solve it, then the homes built will be a waste because the people are unable to buy them. As a result, Malaysians cannot fulfil their dreams of owning their first home,” he says.

Nonetheless, Jagdeep says the state government has discussed the problem with Bank Negara and stakeholders.

“The recent announcement of a reduction in bank loan interest is a positive step forward.”

“We hope this would result in more loans being approved, particularly for first-time home buyers.”

“The state government will continue to engage with Bank Negara to consider introducing better loan packages, for instance disbursing 100% loans; extending the repayment period, reintroducing the developer interest bearing scheme [DIBS] for first-time home buyers, and introducing accelerated and flexible tiered repayment,” he adds.

To assist developers participating in the 100% affordable housing scheme in the current soft economic environment, the state government has allowed 30% of the affordable housing units to be sold on the open market.

But the buyers must be Penang voters, and they are only allowed to purchase one unit.

“Thus, developers can achieve at least 60% sales. This in turn will ensure that eligible applicants have a roof over their heads,” Jagdeep says.

Read More: TheEdgeProperty.com.my

Any affortable housing can offer please??