Rocky second quarter, slower secondary market

Things have been quiet on the Penang primary property market so far, although the secondary market has seen some activity, albeit slower.

“High-end products are struggling but properties below RM700,000 are still okay,” observes Raine & Horne International Zaki + Partners director Michael Geh when presenting the Penang Housing Property Monitor for 2Q2016.

Developments that performed fairly well are Ideal Property Group’s Queens Waterfront Residences and Eastern & Oriental Bhd’s The Tamarind. Properties in Butterworth, especially those below RM500,000, also did well, he adds.

On the mainland, an active hot spot was Simpang Ampat “because it is the secondary market for Batu Kawan, where prices are nearly on a par with those on the island”.

Geh’s advice to homebuyers is that it is a good time to cherry-pick properties. “Zoom in on the neighbourhoods that you like and make offers. Buy with 50% cash,” he says.

Nevertheless, the Penang property market does not appear to be in serious trouble, although, according to Raine & Horne’s State of the Property Market @ August 2016 report, it has seen a dip in transactions and value.

On the primary or developer’s market, the number of transactions fell from 4,095 in 2014 to 2,948 in the following year while the secondary market saw a drop from 14,315 to 12,343. In the same period, value on the primary market declined from RM1.8 billion to RM1.28 billion while on the secondary market, it fell from RM5.78 billion to RM4.89 billion.

Still, Geh feels this is no cause for concern. Jobs are still plentiful, he says, adding that the trigger point for fire sales is when there are retrenchments and factories close down.

Eventful second quarter

A number of unexpected events affected property market sentiment in the second quarter of the year.

“First, there was the continued delay in the issue of advertising permit and developer licences, which took a toll on the property market,” remarks Geh.

“Then, there was the ongoing chief minister’s court case, which caused anxiety among serious property players before they could move on to their next investment decision. News of a possible snap election also jolted the confidence of investors in the market. That this was not going to happen calmed things down.

“Then, there was the announcement of rent control, which rattled investors keen on buying prewar buildings. They are now waiting to see what the state government will do next.” The announcement was due to concerns over foreigners, especially Singaporeans, buying up too many of the prewar shoplots.

However, Geh believes the owners of prewar shoplots are selling because of stringent conservation requirements. They would rather dispose of the properties than renovate them.

“The current procedure for renovation is rather vague … heritage societies have a strong influence on the process. Often, the recommendations for renovation are uneconomic and non-business-friendly, prompting the property owners to just give up and sell out,” he explains.

He suggests that the state government and the George Town World Heritage Inc (GTWHI) review the process to make it viable for owners to renovate their prewar buildings. GTWHI was established by the state government in 2010 to protect, promote and preserve George Town as a sustainable city.

Furthermore, the transport masterplan for Penang seems to have hit a snag with some parties fighting to preserve the Prangin Canal, where a transport hub is to be constructed, because ancient artefacts have been found at the site. Archaeologists have uncovered old sluice gates that had connected the canal, which was built in the early 1800s. Fragments and shards of pottery have also been discovered at the dig.

Geh says as the Prangin Canal was designated a transport hub some 20 years ago, a compromise is needed, where the preservation of the artefacts could continue along with the development of the transport system that Penang requires. Discussions on the matter are ongoing.

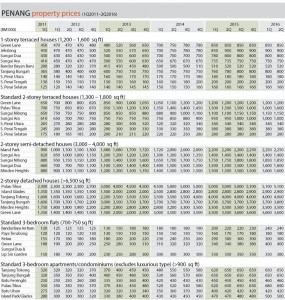

Terraced houses

The 1-storey terraced houses sampled for the monitor on both the island and the mainland showed little price growth from the last quarter and the year before. Prices rose only in Sungai Ara (+2.04% or from RM735,000 to RM750,000) and Tanjung Bungah (+2.56% or from RM780,000 to RM800,000) year on year.

The 2-storey terraced houses in all the areas surveyed showed no price growth from the previous quarter. However, some fared slightly better compared to last year, especially those in Pulau Tikus, Sungai Nibong and Sungai Ara. Elsewhere, the prices remained stagnant.

In Pulau Tikus, the prices rose 6.67% to RM1.6 million, in Sungai Nibong by 4.55% to RM1.15 million and in Sungai Ara by 5.26% to RM1 million.

Semi-detached and detached houses

Quarter on quarter, there was no change in the prices of semidees but they rose slightly year on year, except in Sungai Ara.

Prices rose 2.27% to RM2.25 million in Island Park, by 5.71% to RM1.85 million in Sungai Nibong and by 6.67% to RM1.6 million in both Sungai Dua and Minden Heights.

As for detached houses, only those in Tanjung Bungah saw an increase in prices quarter on quarter (+2.7% to RM3.8 million). Year on year, the prices rose 2% to RM5.1 million in Pulau Tikus, by 3.57% to RM2.9 million in Island Glades and by 2.86% to RM3.6 million in Green Lane.

High-rises

Only the prices of three-bedroom flats in Sungai Dua and Lip Sin Garden rose 8.57% to RM380,000 quarter on quarter and year on year.

The flats in Relau showed no price increase year on year while the prices of flats rose 17.65% to RM400,000 in Green Lane, by 9.09% to RM240,000 in Bandar Baru Air Itam and by 5.88% to RM180,000 in Paya Terubong.

As for 3-bedroom apartments and condominiums, the prices of only those in Pulau Tikus rose 1.47% quarter on quarter and 6.15% year on year to RM690,000.

Year on year, the prices of units in Island Park/Glades rose 6.38% to RM500,000 and by 2.22% to RM460,000 in Batu Ferringhi. Elsewhere, the prices remained unchanged.

Source: TheEdgeProperty.com.my

Looks like everything is slowing down in Penang with the many hiccups faced by the state govt.

It does not augur well for future Penang.

Well those hiccups are due to their own doings…

Property slow down is a nationwide issue. When national income cannot catch up with house price, this is what happens. If you ask me, fed gov should be blamed more for not being able to implement effective policies to increase people’s income. The gap is getting wider every year between Msia & Spore, and narrower between Indonesia & Msia with Indonesia catching up fast.

@alsean

This is an entirely separate issue from development.

People’s voices were ignored and a building of rich heritage was destroyed unceremoniously.

Yes, proceed with development but don’t trample on history, culture and heritage.

This decision actually shows that Penang IS developing. Development in terms of democracy and civil rights.

Not everything about development is taller buildings and comparing whether yours or mine is bigger.

Penang is having too many high rise towers and hence overdeveloped. Penangites should propose to the state that any tower of over 30-storey should be under a stringent ruling. Let’s not giving in to the developers !