Penang developers turn to special schemes and foreign investors

The slump in overall property sales in Penang has led developers to introduce special schemes to stimulate the market.

The slump in overall property sales in Penang has led developers to introduce special schemes to stimulate the market.

Senior general manager of IJM Land Berhad Datuk Toh Chin Leong, who is also Real Estate and Housing Developers Association (Rehda) Penang branch chairman, said IJM is now partnering with Alliance to come up with an income protection plan where house buyers will be covered by insurance against loss of income.

“This is insurance for house buyers so that if they lose their jobs or source of income, the insurance will cover the housing loan instalment so they do not have to worry about defaulting in their payments,” he said.

He believes other Rehda members are also coming up with similar special schemes to attract buyers especially in the middle-to-middle high-income group.

Against the backdrop of a 70 per cent loan rejection rate for consumers, Penang-based developers are facing a lull in the property market that saw the lowest number of transactions in the first quarter of this year since 2011.

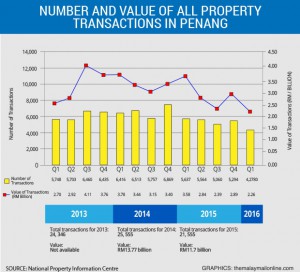

According to figures released by National Property Information Centre (Napic), Penang recorded a total 4,278 transactions in the first quarter of this year as compared to 5,637 in the corresponding period last year.

Even the total property transactions in Penang has dropped in the last two years, from 25,555 transactions in 2014 to 21,555 transactions in 2015.

Toh noted the slowdown in the market, especially in the last two months and possibly for months to come.

“Developers are concerned and we are looking at ways to weather through this so Rehda is initiating discussions with Bank Negara to relax its lending rules, especially for first-time home buyers in the middle-to low-income group,” he said.

Toh said they are also in the middle of discussions with the Penang state government to reduce compliance costs so as to reduce the burden faced by developers in the state.

“Buyers of high-end properties are adopting a wait and see attitude so properties priced above RM500,000 are most affected while properties below RM500,000 are still in high demand but these buyers are not able to get loans,” he said.

In Penang, the amount of property overhang or unsold units is rather low as compared to the number of properties launched; a total 5,334 units were launched in the first quarter of this year and only 1,218 units were unsold.

Napic statistics reveal that a majority of the unsold units in Penang, more than 85 per cent or 1,040 units, are for properties priced above RM400,000.

“The market is now soft so those who can get loans are the ones who can afford to wait because these will be people who are in the high-income bracket and looking at million ringgit properties as investments,” he said.

As a result, he said many developers are also becoming cautious in launching their projects and reducing the number of project launches for now.

Fiabci Penang chairman Datuk Khor Siang Jin concurred that the industry is facing a slowdown but believes the Penang property market will remain resilient against the lull.

“We will be able to weather through this because in Penang, the property market will not be so bad that developers can’t recover from it,” he said.

For now, he said developers can market their projects in the international market to attract foreign buyers instead of focusing only on local buyers.

“We must also follow the market conditions, like our project in Kepala Batas that has properties at below RM400,000… it is doing very well, in fact, our sales were RM100 million, it was a very good margin,” the Hunza Properties executive director said.

Hunza has over 700 acres of land in Kepala Batas and more than 350 acres have been developed with a view of further developing the remaining land soon due to the high demand, he added.

“We still have high demand for residential properties, about 7,000 to 8,000 units each year, so Penang will be just fine,” he said.

He admitted that the main issue now is not in the demand but it lies in the high loan rejection rate that stands at 70 to 80 per cent.

“We really need Bank Negara to relax its lending rules otherwise, it will be hard to overcome this problem,” he said.

Meanwhile, Fiabci Malaysia vice president Michael Geh pointed towards the unusual delay of the advertising permit and developers license (APDL) approvals for Penang projects by the Urban Well-being, Housing and Local Government Ministry.

He said the housing market in the state is also slightly affected by the delay as without the APDL, house buyers can’t sign the sales and purchase agreements and apply for housing loans.

While both Khor and Toh agreed there was a delay in the APDL, they said it only affected certain projects while some projects have obtained their approvals upon appeals.

“Rehda Penang is now compiling the number of projects affected by the delay in APDL approvals and once we have the latest figures, we will submit an appeal to the housing ministry to speed up the approvals,” Toh said.

Since 2014, the number of different projects affected by delays in the approval of APDLs total up to 100.

Source: TheMalayMailOnline.com

Did he really know what we need? A medium income group also can’t afford so call “400K affordable house”. We need a truly affordable house, bank strictly renting money to us because property price too high.

Installment for 400K affordable property is roughly RM2000 per month. If a medium income earn 4000 per month, 50% of salary gone to installment. Balance income is not enough for daily expenses, EPF, Car Loan, saving and etc. Nowadays all new launch property price is above 500K, I really don’t why developer become so greedy..

@Prop

You might want to try attending auctions. They have low cost flats starting from RM10k per unit to RM100k per unit. Quite easy to bid. Go for it.

And you will know what type of neighbours you will have

@Prop

No choice. To own a > 400K house, husband and wife need to work together.

Sorry, no more “housewife” in the future……Haha.

Otherwise, your husband need to earn > 7K above.

u see the title? aim international market and foreigner investor due to local buyer keep loan rejected by bank, no money no talk…nowadays property not for stay but just for invest, u can see over 90% units empty after oc, these unit only for rent or sell.

@Getha

Well, if you can only afford a 100k home, then that’s what you need to accept. You can’t blame others because you’re poor, right?

“majority of the unsold units in Penang, more than 85 per cent or 1,040 units, are for properties priced above RM400,000.”

I think this statistic sums up the root cause of the problem quite clearly. It is NOT because of BNM’s strict lending rules that is the problem.

The strict lending rules are meant to ensure that people buy properties that they can afford.

The problem is a mismatch in supply and demand. Developers are supplying properties priced more than 400k that the average wage earner cannot afford.

The rich (investors) who can afford properties more than 400k are not going to buy these properties for now because they know they cannot flip it for a profit to unsuspecting buyers as the pool of gullible buyers they can sell to has been limited by BNM lending curbs.

Now the developers want to cry father cry mother that they cannot sell their ‘mis-priced products’

Its like trying to sell ferrari or BMW to average worker.

When the average worker cannot get loan to buy, the developers say is BNM’s fault for not allowing the worker to get loan to buy their products.

Foreigners can buy only 1 million n above prop only kan?

property price has not reached the bottom yet.. those managed to subsale their units last year considered yourselves lucky.. should celebrate..

those who bought from not so established developers, beware that your project might be abandoned…

My bro and his GF able to buy 500k property and manage to secure a loan from Maybank with combined income about 6k+… Want buy house save more cash and spend less on vacation. The market must be stable in order for us to earn, buying a house making loss is ridiculous in Penang.

@ryu

that is more alarming. With 6k you can get loans of 500k. It means that those got rejected are in much worse shape than this.

You think rich foreigners stupid. What is so special about Penang anyway. If I am a rich foreigner with loads of cash to spare, I will buy properties in Australia, Rurope or US.

Enough said, only fool will rush into property now. Save cash is the king when 2017 is just near the corner. look at the past history of 1997, 2007 and now

Rich oso got high low end one, think most come here one are low end one but still richer than most Pg lang.

Low end rich bank account = min RM5mil

Middle end rich bank account = min RM10mil

High end rich bank account = min RM50mil

Super high end rich bank account = min RM100mil

@Jan, fresh graduates now already earning about 2.5k to 3k min for a degree holder. Life is not difficult as you said. Even my friend who worked in Intel, 350k loan is not an issue for him. Imagine those professionals working in Citi group or AirAsia, their salaries even higher than local company.

@ryu The problem is all penang new launch property is 500K above, these price also become a burden to those professionals with higher pay. Now economy is not very well, a professionals may lose them job in any time (If a company want fired/VSS staff, usually staff with higher pay will be first target).

@ryu The problem is almost penang new launch property is 500K above, these price also become a burden to those professionals with higher pay. Now economy is not very well, a professionals may lose them job in any time (If a company want fired/VSS staff, usually staff with higher pay will be first target).

@Prop

Buy property sure got burden one mah, and not only property, other things like cars also burden mah. Dont want burden, then become a monk and live in the temple lor, zero burden!

nowadays rugi 20-30k considered lucky d… those put in 100-200k to renovate

those put in 100-200k to renovate but still no taker or tenant one are the biggest loser..

@ryu

What I meant is 6k can get 500k loan, and quoted as example. That means there are a lot of those who earn less than that and loans got rejected. The salary is not catching up (may be because of the skillset). So this is alarming.

I am in the fiz for more than 15 years and yes I know the salaries.

@ ryu My first job when I graduated had a salary of RM1000. And I bought my first house( a double storey) a few years later for RM50,000. Fast forwarded to 2016, fresh graduates pay about RM2,500 but a landed property will cost him also a million. So how can you say life is not hard.

@apple, those put in 100k-200k to renovate already stay there. Think logically if you want to outsider(s), you wont spend so much to renovate your unit~.

@prop, who tell you our economy is doing not well, many luxury condos like Tamarind, Queensbay Residences almost “sold out”. 500k is just a normal game for those professional. Want good life should work harder, every jobs also got pros and cons. No point blaming Penang’s house is expensive bla bla bla (this grandma’s story already heard 10 years ago).

I always feel our life is all about progress. Just like when we were schooling, we worked hard to get good results and graduate. In work life, we attend courses and go for MBA etc to progress in our profession. So same goes for our house. We could start small, then later progress to bigger and better house. But problem is nowadays some want shortcut. Can’t earn as much but want to aim/buy more expensive house. If $500k is stretching for you, look at $300-400k ones. They could be smaller, older, further out of town but it’s still a start. Don’t complain 500k is so expensive/who can afford etc because believe me, many professionals can and even more. But they last time also started small. Take 1 step at a time. Upgrade later when you have build up your funds and higher salary. Learn to be appreciative of the things we have. To each it’s own. If always complain, it will only hold you back. Look to the future… a brighter one. Plan your finances well and even IF prices drop 10%, as long as you can hold, you will definitely ride through it.

Deiiii, last time work hard age 30 can buy merc, bmw and semi d at porch area and oversea vacation already lor.

Now work hard till age 40 just can afford japanese car and square box condo and vacation within malaysia. So ? This is not about work hard or not right?

Ya lor, it’s a fact that house price for the last 6 years has outrun income (general). It should not be sustainable, and this is what’s happening now, slow property sales and downward price. We should let it run it’s course, and don’t listen to all the rubbish by developers that BNM should make it easier for home buyers to use their future money to buy house. There are simply too many developers nowadays, we should let half of them close shop first.

PG property prices are crazily high. Even for the low end rich. It is as expensive as Singapore or Hong Kong dollar to dollar. For foreign investors why should they buy PG property at million dollar prices if they are not staying in it? Rental market is weak. If buy a hse for 1.6-2 mil to rent at 3k plus, better put cash in bank special account and earn interest at 4%. Who can they resell it to next time? definitely not a local.