Cars are more expensive than houses?

In about 3 weeks’ time, we will be celebrating the New Year.

In about 3 weeks’ time, we will be celebrating the New Year.

Each New Year comes with new resolutions and new goals. Some would plan to own big ticket items such as a house or a car as part of their resolution. If your plan is to own a new car, finish reading this article before nailing down that resolution.

Owning a car in Malaysia is expensive. In one of my previous articles, I highlighted that Malaysia was ranked second in the world where owning a car is expensive.

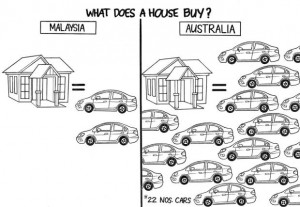

But what many do not know is by how much, relative to homes. Yes, homes in Malaysia are expensive too, but relative to Australian homes and cars, our cars are 10 times more expensive than those sold in Australia compared to homes. Let’s do some simple math together.

Khazanah Research Institute (KRI) reported that the median house price in Malaysia is about RM250,000. This is the cost of two Honda Civics (priced at RM110,000 per car).

In Australia, the median house price is A$660,000, while a Honda Civic costs about A$30,000. This means, a median-priced Australian house of A$660,000 can buy 22 Honda Civics, versus a median-priced Malaysian house of RM250,000 which can only buy two cars of the same model. Yes, our homes may not be cheap but our cars are more expensive in comparison.

I further compared Malaysia against the United States and United Kingdom. A median-priced house in US and UK can buy 12 and 16 Honda Civics respectively, which is still more affordable compared to the two which can be bought with a median-priced Malaysian house.

The story does not end here. In addition to the cost of purchasing a car, there are many other financial commitments that comes along with owning a car. These include petrol, parking, toll charges, maintenance, and repair costs. Then, there is the cost of depreciation which ranges from 10% to 20% per year. It does not help that most of these supplementary expenses are frequently being increased. Our cars are indeed costing us a lot.

It is undeniable that a car is a necessity to those who have limited access to public transportation. Until our public transportation system is good enough, people will still need private vehicles to move from one place to another.

Unfortunately our cars are so expensive that the rakyat, especially the younger generation, are forced to put off buying a home until they can afford it. In the meantime, that “wait” causes house prices to appreciate, thus making it even more unaffordable for these people to own a home. This vicious cycle will continue until the government has a permanent solution to address both public transportation and affordable housing.

Perhaps, it is also timely to revisit the rationale behind our National Car Project which was introduced in 1982 to bring a higher level of industrialisation in Malaysia. Since its inception, the price of national and non-national cars have progressively increased through increase in car taxes and excise duties.

The price of non-national cars in Malaysia generally cost 50% to 100% more than the price of the similar make of car in other countries. On the other hand, one of my managers came back from his Aussie trip and shared that a Proton Preve in Australia is RM11,000 cheaper than one that is acquired in Malaysia.

Originally, the National Car Project was a form of protectionism for the national car industry. After more than 30 years since its inception, it has now become a burden to the rakyat, by eating more and more into our disposable income. The National Car Project has served its original purpose, and it is time that we review it.

So now, instead of jotting down my resolution, my wish list for 2016 is for the Government to rationalise and reduce the taxes imposed on cars. This will put more money back into the rakyat’s pockets to start their home ownership journey much earlier. Concurrently, the Government can continue to channel and reinvest some of these funds to build a comprehensive and effective public transportation system in Malaysia which will greatly reduce the rakyat’s dependency on private vehicles.

And for those who still wish to buy a car, think twice as owning a car is too expensive and unaffordable – it may also cost you your home.

Datuk Alan Tong has over 50 years of experience in property development. He was the world president of FIABCI International for 2005/2006 and awarded the Property Man of the Year 2010 at FIABCI Malaysia Property Award. He is also the group chairman of Bukit Kiara Properties. For feedback, please email feedback@fiabci-asiapacific.com.

Source: TheStar.com.my

This is a very interesting discussion by Alan Tong, who seems to be obsessed with car prices all his life, and when talking about high prices of homes in Msia, he always asks gov to reduce car price, so that homes will become more affordable to people. That’s an argument with a very big FLAW!

My argument is that no matter how low you reduce car price to (to the extend of totally TAX FREE), but without anti-speculative measures in place for home purchase, homes will remain UNAFFORDABLE. Anti-speculative measures for home purchase must always be there, otherwise banks will go reckless in lending, speculators will go reckless in borrowing, the rich gets richer, the poor gets poorer, consequently resulting in social inequality.

First time in this website, comment is more agreeable than the original post.

@HairyRambutan

Ha ha ha , this article is due to properties sales downtrend liow, losing and affected by car sales. So, complain about car price lo.

From property developer standpoint, their properties sold are always NEVER expensive. To them, it is always other products, such as cars that are more expensive, so trying to blame the car instead. So, don’t buy car, buy bungalow and use bicycle or walking ?

But, the rakyat knows well, BOTH houses and cars are DAMM expensive !.

Why compare with Australia, US, UK ? Same country sizes, economy model, background, etc with Malaysia ?

My wish list for 2016 is to curb greedy unscrupulous developers and curb reckless speculators. Of course, cheaper cars is my secondary wish list also.

Spiderman can web swinging, no need car lah, don’t care about car price lah. He he he.

Datuk, please lah venture into car business. Thereafter, write an article about how expensive is the houses price as it is affecting your car business and sales. ha ha.