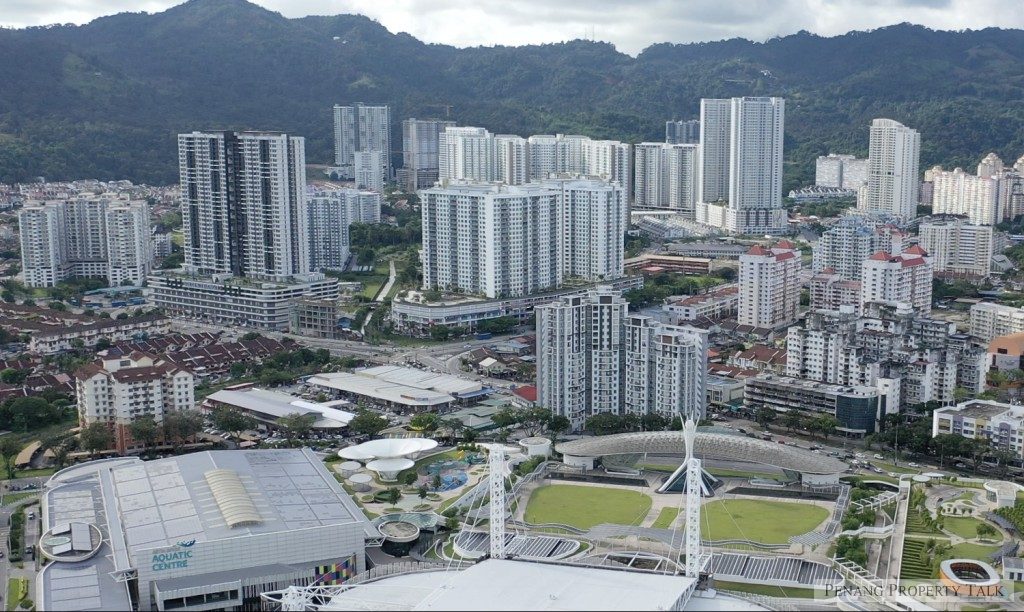

Escalating prices dash homeownership dreams for Malaysian millennials

The aspiration of owning a home, a cornerstone of financial stability and future planning, remains an uphill battle for many Malaysian millennials residing in major cities. The intertwining factors of skyrocketing property prices and an unyielding surge in the cost of living create a formidable barrier, leaving the younger generation, aged 25 to 45, grappling with deferred homeownership despite government initiatives like the National Affordable Housing Policy.

Over-commitment

A comprehensive study conducted by Universiti Putra Malaysia underscores the financial challenges gripping the younger generation. Dr. Mohammad Mujaheed Hassan, from the Urban and Regional Planning Department, reveals a stark reality: high financial commitments, including monthly car installments, credit card debts, and rental expenses, are stifling the ability to accumulate savings for a home. The symbolism attached to car ownership, despite some individuals relying on public transport, leads to over-commitment, leaving limited disposable income for savings or investment.

Wrong Estimates

Contrary to their financial capacity to afford homes based on monthly rental payments, many millennials prefer the perceived financial safety net of renting. Dr. Mohammad Mujaheed’s insights suggest that additional costs associated with homeownership, such as taxes, maintenance fees, and the perceived distance from workplaces, deter the younger generation from taking the homeownership plunge. Personal loans and credit card debts further contribute to their financial quagmire, pushing homeownership down the list of priorities.

Worrying Trends

The trend of prioritizing short-term financial commitments over the long-term goal of homeownership raises red flags. Dr. Mohammad Mujaheed warns that such prioritization could lead to prolonged debts, potential blacklisting by financial agencies, and a cascade of issues, including financial stress and limited housing options in the future. The urgent need to address these concerns is underscored by the looming possibility of a segment of the younger generation facing homelessness or perpetual renting from one generation to the next.

Housing Affordability Gap

Dr. Azizul Azli from Universiti Teknologi Mara sheds light on the widening chasm between income levels and house prices, characterizing it as a significant roadblock to homeownership. Annual salary increments fall far behind the rapid surge in property values, creating an insurmountable gap. Azli advocates for proactive government intervention, emphasizing the necessity of incentives for developers to construct more affordable landed houses and a streamlined approach to bureaucratic processes that contribute to escalating construction costs.

The financial stretch of urban living in Malaysia, coupled with the millennials’ penchant for immediate gratification, places the dream of homeownership at a critical juncture. Overcoming over-commitment, dispelling wrong estimates, addressing worrying trends, and bridging the housing affordability gap require a concerted effort from both policymakers and developers. Government initiatives, coupled with strategic incentives for affordable housing development, hold the key to transforming the homeownership dream from an elusive pursuit into a tangible reality for the younger generation. As the nation grapples with economic dynamics, ensuring that millennials can secure a stable housing foundation becomes paramount for their future and the overall socioeconomic landscape.

Property prices have not been escalating for many years, instead there was a decline. The problem of millennials not able to afford homes is not due to escalating prices, but due to low wages, wages that are not able to keep up with general inflation. And why are wages low? Major contributing factor is our bumi tertiary education policy which allocates places based on racial quota, instead of pure merits, resulting in low graduate quality, which affects our country’s ability to attract high value-add foreign investments that bring higher wages.

@leciao

My humble opinion here.. instead of relay to wage..why not start to do self business &start from small. It’s alike Nasi kandar & slowly to grow..

@Deen Yassin

So, when wage earners earn 1.5k a month, they eat bare basic nasi kandar+egg+kobis. But when they earn 4k a month, they add on chic+sotong. When wage earners earn less, they consume less, so less profit for the nasi kandar business. When wages double, they spend more, hence profits for nasi kandar business also increase. Long story short, when you let talents flourish FREELY, without university quotas, EVERYONE gains, regardless of race or occupation. That’s why even cleaners get paid SGD3000 (RM10,500) in Spore.

nothing wrong with perpetual renting, advance economies (US,Aus,Japan,S Korea..) have much lower home ownership. if these people’s life goal does not include home ownership , so be it…

Well most engineer kia from FTZ might be able to buy, those not Engineer kia possible will take forever to get a home, LC, LMC….cannot harap to get also.

Education is very important to get high paid salary, most of my classmates around 30 years old already bought houses in Penang island. Chinese can buy houses without problem, because we concentrate on what we want and never rely on government.

Last salary only RM1,500 once graduate

Now salary RM3,000 once graduate

I dont see any issue here, they need to just GROW UP instead of blaming

@MajorArches

Most penangkia from island as I know got lesser interest to work at FTZ. You can look at the morning traffic how many from Georgetown going out. Mostly is coming in.

Most FTZ workers from mainland.

So those mainland kia with “Cheaper” house also know to come FTZ work, then who to blame for those Island kia that can’t afford to?

If Engineer salary 5k can buy 400k house, then those non-engineer kia salary 2k should can budget on those below 150k, there always option of house, just probably not your favored one.

Pakai topi ukuran kepala.

@Minion

Agree.

RM5k got 5k’s living, RM2k got 2k’s living, don’t follow this that and make your life hard.

Penang always got available house, just the house probably not into their eyes.

2k salary, but want 5k income condo.