Affordability issues continue to loom over potential homebuyers

PropertyGuru Malaysia released its biannual Consumer Sentiment Study for H2 2022, which found that potential homebuyers are facing affordability issues in their homeownership journey, with 51% of respondents understanding that they are not qualified for government affordable housing schemes, and are not able to purchase property without financial assistance.

With the overnight policy rate (OPR) increase by 25 basis points in July, on top of the consumer price index (CPI) rising to an ultimate high of 4.4% year-on-year, potential homebuyers may continue to face affordability issues amid concerns over the ongoing global recession and inflation rates. This was evident in the Consumer Sentiment Study for H2 2022 (CSS H2 2022), as about half of the respondents surveyed stated that they do not qualify for government housing schemes and may not be able to afford to purchase a property without assistance.

In the study, 73% of the respondents have a clear understanding of eligibility terms for affordable housing, indicating that potential homebuyers will continue to be on the lookout for other government housing initiatives to aid their homeownership journeys.

Sheldon Fernandez, Country Manager, Malaysia (PropertyGuru.com.my and iProperty.com.my), said, “As seen in the Consumer Sentiment Study H2 2022, our consumers have a sound awareness of government initiatives and eligibility for affordable housing. With the ongoing recession, inflation, price hikes, and OPR increase, we expect potential homebuyers to continue the wait-and-see approach until the overall cost of living has stabilised.

With the Budget 2023 announcement coming up soon, we are hopeful that there will be allocations that can help spur the property market and aid those that are planning to embark on their homeownership journey. The CSS H2 2022 has also indicated that more than 69% of those surveyed plan to buy a house if the Home Ownership Campaign is revived.”

Emerging Technology Will Continue to Change Large Purchasing Behaviours in Consumers

The previous Consumer Sentiment Study in H1 2022 recorded that 2 in 3 Malaysians would be comfortable with shortlisting and viewing properties online, while 1 in 4 would be comfortable signing agreements online. This signals that consumers have become more tech-savvy following the reliance on digital transactions during the pandemic.

This trend continues in the latest CSS H2 2022, as over half of the respondents in the study see that emerging technologies such as AI, property aggregation platforms, and digital housing societies would be helpful in their homeownership journey. This indicates that technology will continue to play a major role in the property market, and a demand for digital accessibility to property-related decisions will likely continue in the coming years.

“As a leading proptech company, these findings have proven that providing a platform that can help to guide consumers in making informed property decisions is a crucial part of a homebuyers’ journey. The way that consumers digest information and make transactions is evolving, which is why we strive to be an innovative platform that can help potential homebuyers achieve their goals as conveniently and with as much guidance as possible. In addition, through the survey, we found that potential homebuyers have also started to consider purchasing property in the metaverse. This trend is likely to continue as consumers in Malaysia have adapted well to digital solutions and platforms more than ever over the past two years. We are interested to see how emerging technologies will change and evolve in the industry in the coming years,” said Sheldon.

Environmental Impact Has Changed the Way Potential Homebuyers View Locations

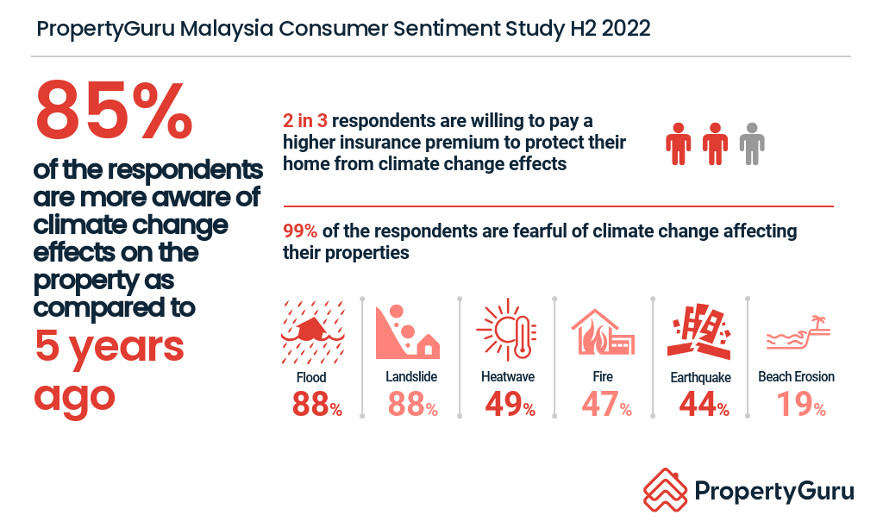

As several areas across Malaysia have been struck with flash floods and landslides in the past year, the study also indicated that homebuyers are concerned with how this will impact properties in the long run. 92% of the respondents in the study had highlighted flooding as their main concern, while 83% were concerned about landslides.

With environmental consciousness recording an upward trend, consumers are now looking at sustainable homes and features as key considerations when purchasing a home. Additionally, according to the CSS H2 2022, respondents noted that solar panels, rainwater harvesting, and food waste composting are important features to have in the future. On top of this, 1 in 3 of respondents in the higher income group is keen to pay more for a property with Electric Vehicle (EV)-charging ports.

“While location has always been one of the key considerations for home seekers in Malaysia, we will now see more people increasingly prioritise this due to the flooding events in the past year. The higher awareness of eco-friendly facilities and features is likely linked to ongoing climate change issues as well. Consumers are now more conscious of current issues and are now making eco-friendly decisions in hopes of making a change.

With many losing and damaging their homes in the past year, it is evident that these natural disasters have made a lasting impact, as in the CSS H2 2022, 66% of the respondents said they are willing to pay a higher insurance premium on their property for climate change effects as nobody foresees their home being struck by a flood or any natural disaster”, concluded Sheldon.