Penang Property Outlook: The COVID-19 Effect

As the effects of COVID-19 pandemic are felt around the world, property is undoubtedly one of the most impacted industries in Penang. Although CMCO is now lifted, the ongoing corresponding containment measures are expected to worsen the already slow and cautious property market here.

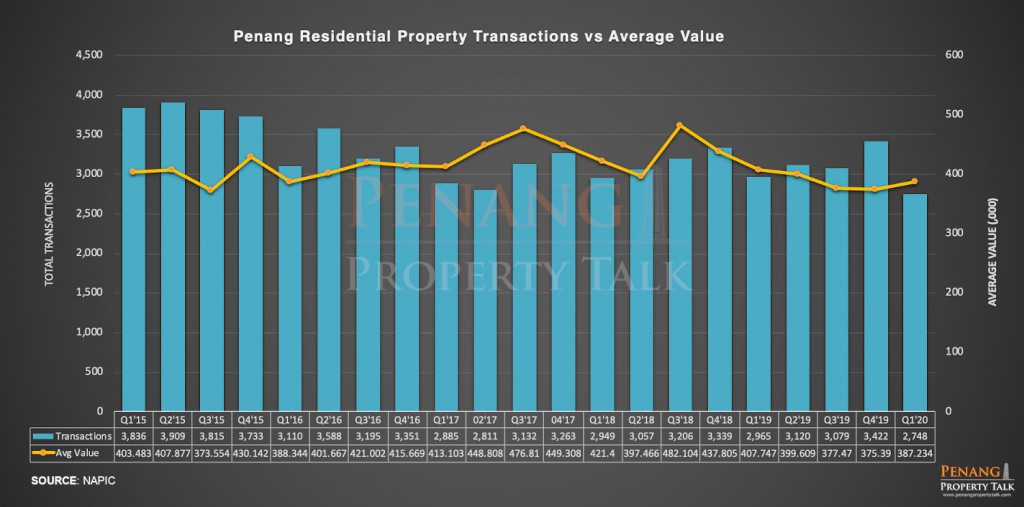

Looking back at the first quarter of 2020, Penang property market saw the continuation of a slowing market with quarterly residential transaction volume at its 5-year low. While the HOC played a role in easing the glut in the residential property market last year, it did not raise the consumers’ confidence which is the key factor in driving the recovery of the property sector. The data from NAPIC below shows a horizontal trend in property transactions and the continuous decline in the average transacted value for Penang residential segments through 2019, with a slight increase in Q1 2020.

The disruption of COVID-19 pandemic

The MCO which lasted for 2 months and the ongoing control measures are certainly stretching the sluggish property market. Demand is disrupted and supply is expected to be delayed. Many developers are likely to miss their completion deadlines. Few new launches are to be put on hold and some have been temporarily called off. Some will be facing strong headwinds ahead, especially those selling midrange products with low-profit margins.

Investors who have been generating income from their home-stay units have lost a few months of income, and their losses are likely to continue for several more months. Commercial property owners are pressured to slash their rental in bid to keep the tenants and some co-working spaces are closing down amid the new norm of social distancing. Several hotels ceased operations due to the gloomy business outlook.

Low-middle income earners hit hardest

The pandemic has also disproportionately affected low and middle-income workers, many of whom may have faced salary cut or job instability. This would have a direct impact on the demand for property, especially in the low and medium-cost category.

The situation will contribute to a decrease in property transactions for the remaining quarters in 2020. However, with a lower ratio of transactions in low and medium-cost housing, we are likely to see an increase in the average transacted price in the second half of 2020. This should not be perceived as rising house prices.

Property price falling with incentive by the government

Following the introduction of Penjana incentives, most developers are expected to lower their prices by 10%. Not to mention some of those who are already offering huge rebates and discounts in response to the decline in sales since early 2020.

This will also have a spillover effect on the sub-sale market, competing with the sale of developers’ unsold housing stock at a lower asking price. The real property gains tax (RPGT) exemption would be another motivating factor for owners to dispose their properties before 2021 at a reduced asking price.

While Penang Government is lowering affordable housing prices by 10%, but that will not have any material impact on the market in near-term as that is only applicable to new projects. Nonetheless, affordable housing will be cheaper when this takes place.

Is now a good time to invest in property?

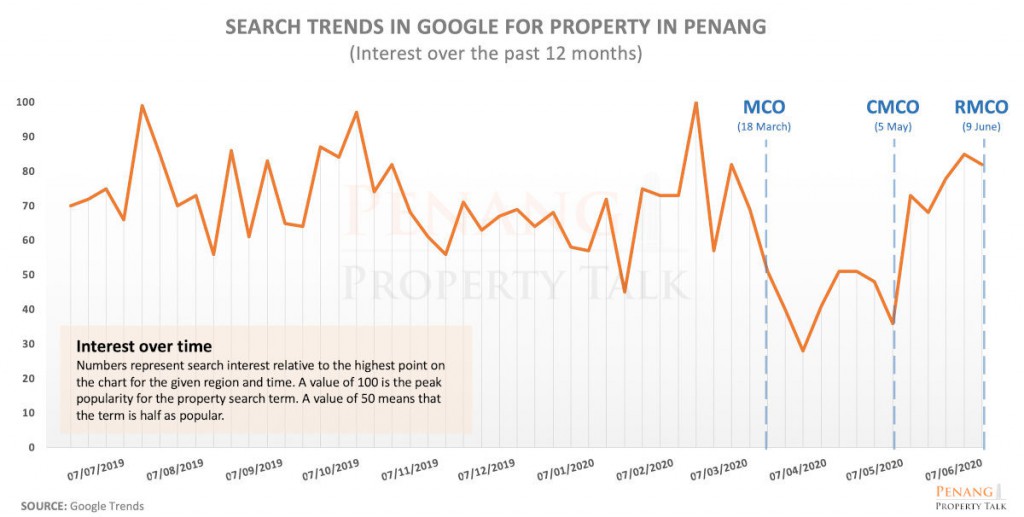

Although our daily lives have been disrupted, property does not lose its attractiveness for investors as it is considered a stable investment in times of crisis. This is evidenced in the search trends report below from Google, indicating the search interest for property in Penang has rebounded to pre-crisis level after the MCO is lifted.

The Penjana incentives, which include the reintroduction of Home Ownership Campaign (HOC) and the removal of 70% financing limit for the 3rd housing loan, are expected to keep the property buying momentum going over the next several months.

For those who can afford, this would be the best time to scout for the right one as the property prices are expected to be softened, and owners in the sub-sale market are likely to lower their asking price.

Buy within your means, and only for long-term or own stay. If you are buying a commercial property for rental, it is time to rethink your investment strategy with a realistic target in mind. The new norm may or may not go away. For residential property, buying affordable housing for investment is not a wise choice for now as it will only get cheaper in the foreseeable future.

– Ken Lim

(Founder, PenangPropertyTalk.com)

What is the limit for existing properties for Australian purchases?