Residential property sales in Penang this year to be record high since 2016

Michael Geh

The housing market in the country is expected to be at a record high by the end of this year since 2016, a real estate agent forecasted today.

Raine & Horne International Senior Partner Michael Geh predicted that a RM71.03 billion worth of residential properties will be sold by the end of 2019.

The registered surveyor said a total 204,840 units of properties are expected to be sold for the whole of 2019.

“This will be the highest number of transactions in four years,” the Fiabci Malaysia president said.

“A majority of the transactions are in the secondary market, but we can see increases in sales in both the primary and secondary markets,” Geh said.

The primary market refers to new property launches while the secondary market refers to the resale of pre-owned properties.

He attributed the bullish residential property market this year to the housing policies introduced by Putrajaya such as the Home Ownership Campaign.

“Positive policies to spur the housing industry have been effective to move the market in the first half of the year and this trend is expected to continue for the rest of the year,” he said.

He said the reduction of threshold prices for foreign purchasers from RM1 million to RM600,000 will continue to give positive impacts to the housing market next year.

When asked about the residential property glut and overhang, Geh said this only affects projects located in less sellable locations.

“Property stocks are dependent on land economics so projects that are in a desirable location are easily sold compared to those located in inaccessible, poor connectivity areas,” he said.

Geh added that there will be overhang units if these properties are built-in undesirable locations as people would not want to buy and live in such areas.

He defined undesirable locations as places without proper infrastructure and public transport connecting it to the cities and areas that are too far from facilities and amenities.

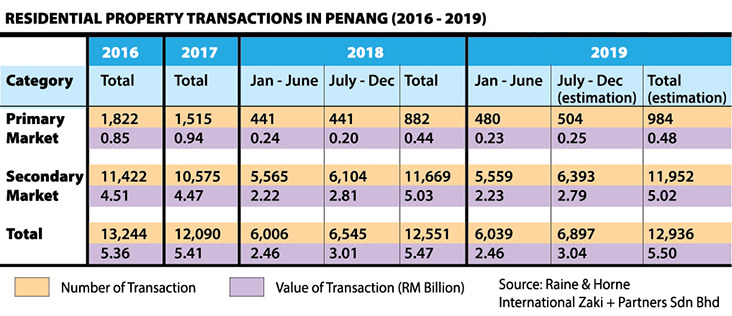

Over in Penang, Geh also predicted that the state will record the highest total transactions in three years.

He estimated the total residential property transactions in Penang for 2019 to reach 12,956 units worth a total RM5.5 billion.

Last year, only a total 12,552 transactions valued at RM5.47 billion were recorded in Penang.

He said the increases are noted in both the primary and secondary markets.

He estimated a total of 984 transactions valued at RM480 million are expected in the primary market while a total of 11,952 transactions valued at RM5.02 billion are expected in the primary market for 2019.

“A majority of the residential property transactions in the first half of 2019, at 68 per cent or 4,112 units, are made up of properties valued at below RM400,000 while the remaining are of properties priced above RM400,000,” he said.

Only 6 per cent or 390 units of the transactions are for properties priced above RM1 million, 17 per cent or 1,023 units for properties priced between RM500,000 and RM1 million and 9 per cent or 514 units for properties priced between RM400,000 and RM500,000.

A majority of the properties transacted are two to three-storey terrace houses (18 per cent), flats (17 per cent), low-cost flats (16 per cent), condominiums and apartments (16 per cent) and single-storey terrace houses (11 per cent), he said.

“Most of the properties sold are in the Northeast district on the island (32 per cent) and this is followed by Central Seberang Perai (25 per cent), North Seberang Perai (17 per cent), South Seberang Perai (14 per cent) and Southwest district on the island (12 per cent).

Geh said Penang has a total of 3,929 units of overhang residential properties as at the first quarter of 2019 with a large number of it — 2,621 units — being condominiums and apartments.

This is followed by 364 units of two to three-storey semi-detached houses, 240 units of flats, 227 units of detached houses, 200 units of two to three-storey terrace houses, 152 units of low-cost flats, 92 units of townhouses and 33 units of single-storey semi-detached houses.

“A majority of the overhang units are on the island with 40 per cent in the Northeast district and 36 per cent in the Southwest district as at the second quarter of 2019,” he said.

The percentage of overhang units on the mainland as at the second quarter of 2019 was 16 per cent in Central Seberang Perai, four per cent in North Seberang Perai and four per cent in South Seberang Perai.

He said there was a large number of unsold units for residential properties still under construction which totalled at 9,907 units as at the first quarter of 2019.

“A majority of these are condominiums and apartments (8,956 units), to be followed by two to three-storey terrace houses (406 units), two to three-storey semi-detached houses (223 units), low cost flats (207 units), flats (79 units), detached houses (29 units) and cluster houses (7 units),” he said.

Most of these units under construction that are unsold are on the island (78 per cent) while the remaining are in Central Seberang Perai (11 per cent), South Seberang Perai (8 per cent) and North Seberang Perai (3 per cent).

Geh said the federal government’s policy to spur the residential housing market and to clear the overhang meant that the residential property market will continue to be strong next year.

Source: Malay Mail

Don’t be mislead by the headline of “Residential property sales in Penang this year to be record high since 2016”. Excerpts from what Mr Geh said like “projects that are in a desirable location are easily sold”, “highest number of transactions in four years” & “highest total transactions” are intended to paint a false picture of optimism amid the current gloomy sentiment.

A few reasons to property price stagnation for the many years (at least 10 years) to come :-

(1) there is still a big inventory of properties being built in Penang and will be coming into the market in the next 18 months

(2) a policy blunder by penang state gov of allowing extremely high plot ratio which enables developers to build easily 800-1000 units of condos per project

(3) CM Chow just confirmed that there will be 10,000 units of new condos by year 2024 in mount erskhine area alone and hence justify to build a tunnel at Gottlieb/Burma Rd junction

(3) no reason for short AND long term investors to buy as short term investors can’t flip and long term investors can’t rent out their units at reasonable rental.

(4) Even occupiers are better off renting than buying in view of the current “irrationally low” rentals

Agreed to what Momo had highlighted. the affordable units are started floating everywhere, and with the existing empty units throughout most of the projects, there are not even half occupied for many… it will take many years to come.

Developers are very desperate nowadays. Market so soft still dare to build.

If developer doesnt build, contractors no job, bank less opportunity, professional sector (lawyer, M&E, engineers, supplier , manufacturer) all sector going down.

what industry u from will have impact directly..

no developers as T20 will not be able to give opportunity to B40

) yes, big inventory, but development stagnancy is bad for economy, affordable houses are build by government to fulfill promises, but mentality of penang people, youngster especailly, buy for rent/sell and ivnestment.

2) plot ratio is 2.5, comparing to KL is about 5

3) build tunnel, nothing is wrong, u staying that area? dont complain when youyr next-of-kin got no houses to buy in future. more supply = stagnancy of the price, means your children have chance to afford the house and price wont go sky high.

4) nowadays most of the properties that purchased, new projects, are not doing well, are we still talking about bulk investors?

5) renting vs buying, this is something in penang that will never happen. for local mentality, will definitely go for buying instead of renting

Developers don’t care about contractors, banking, lawyer, suppliers and B40 etc. They only care about profit. Keeping building while no demand is creating a bubble waiting to burst.

I hope the bubble burst. investors who buy to rent out are so desperate now they start renting out service apartments to a dozen blue collared foreign workers like flats. More so, investors are not paying maintenance fees from having to hold on to an unsellable property. And with developers using lousy materials new buildings are suffering from wear and tear in less than 6 months. The good side is more people buy to stay nowadays.

@Moby

You are already looking at almost the worst now, if not the worst. The property market has already been subjected to a practical stress test, and it didnt collapse although prices have come down quite significantly. Nevertheless, the market will remain depressed for at least another 3 years, but definitely things will not get much worse than what it is today.

@Moby, still many young professionals bought 700k+ property. I and my friends just bought Queen waterfront, Setia Skyville, Quaywest etc. Penang’s market won’t collapse so easy.

Youngsters don’t rush into property your life quality will be ruin by the loan repayment unless you have YJ as your daddy.

I was forced to retired next year at age 60, I was hoping so much the YJ can extend my contract but look like he is grabbing the extended contract for himself and he forcing all those old rubbish to retire. I still have 10 years house loan to go, that is really no life, my family will eat sand next year.

@David Wong

Your EPF should have few millions kua…

@David, I saw many 40 years old people bought their house and facing many financial problems. Parents are old, kids are young and housing loan, renovation costs etc will kill them. Imagine if you buy at age of 30 or lower, you still got 10 years and you will finish paying your housing loan earlier but not 60 years old. Don’t make your life difficult when old because nobody will be there to help or support you. Bankers still prefer to borrow loans to youngsters compared to 40+ Because age is a factor not a number.

@ryu

It’s GENERALLY true that the earlier you start the better, but that shouldn’t be the only factor. Knowing your timing and location can make quite a difference in the end result.

For David’s case, I wouldn’t jump to conclude that he is in a bad situation. He could be 60 with another 10 years to go with his mortgage, but that scenario could well be :-

(1) He bought his house 25 years ago in 1994 and took up a housing loan of 35-year tenure (therefore leaving him another 10 years to go)

(2) In 1994, a landed 2 storey house in Greenland or an upscale condo in Gurney Drive only cost ~RM300k, which would be worth at least RM1 mil today.

(3) He only needed a monthly income of RM5000 then to afford the monthly instalment of RM1500.

(4) Since he mentioned he still has 10 years to go with his mortgage, which implies he has been servicing his loan without fail in the past 25 years, that would make his outstanding principal about RM 140k today (assuming he took a loan of 90% of house price of RM300k)

(5) So he owns a RM1 mil asset with a RM140k outstanding loan,which leaves him a net of RM860k.

(6) He can at any time sell his asset, pay off his loan so that he can be debt free, buy a RM600k condo for his retirement, and still have RM240k left for a new car.

So does the “I am 60 now and still have 10 years mortgage to pay” sound so bad now?

You are half right about my situation but you might not know that I have to mortgage my house and sell off everything I have 10 years ago to settle a commercial cheating case in China, I lost everything for the greedy and have to restart a life at 50 just because greedy.

I hope to get a security post next year, anyone want to hire me ?