Property crowdfunding framework unveiled

The Securities Commission Malaysia (SC) has released a new property crowdfunding framework, following revisions made to its Guidelines on Recognised Markets here today.

This is in relation to an initiative announced in Budget 2019 to provide an alternative financing avenue for first-time homebuyers through a property crowdfunding scheme, said SC chairman Datuk Syed Zaid Albar in his opening remarks at the inaugural SC Fintech Roundtable held here today.

“The SC is supportive of ideas that utilise technology to benefit investors by democratising access to investments while broadening financing options available for Malaysians,” he said.

“As such, we are pleased to announce that we revised our Guidelines on Recognised Markets today. The revised guidelines will introduce new requirements to facilitate property crowdfunding,” he added.

Property crowdfunding offers the same potential as that of equity crowdfunding (ECF) and peer-to-peer (P2P) financing platforms in providing an alternative source of financing but is specifically tailored for first-time homebuyers, said SC in statement today, adding that it will also provide investors access to a new investment option.

Eligibility criteria

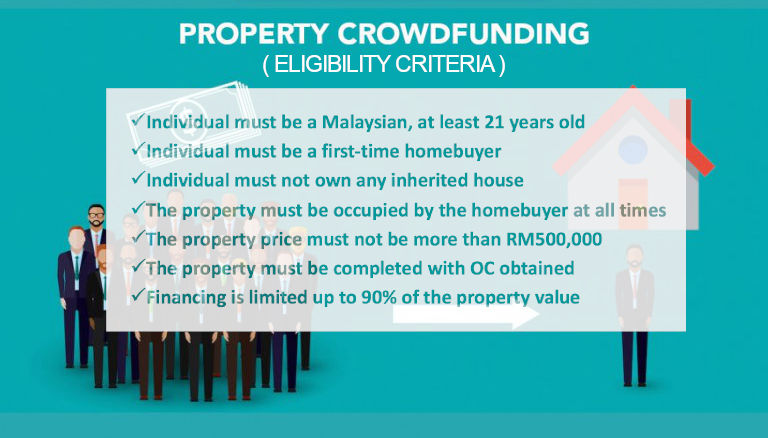

Under the property crowdfunding scheme, at the initial phases, only eligible properties and homebuyers will be allowed to participate.

Some of the eligibility criteria of homebuyers are that the individual has to be Malaysian, at least 21 years old, and a first-time homebuyer.

During the technical briefing two days ago, SC’s spokesperson also noted that an individual is not eligible for this scheme if the individual had inherited a house from the person’s family.

An obligation of the homebuyer, under this scheme, is that the property must be occupied by the homebuyer at all times.

However, the homebuyer is permitted to rent out rooms in the property during the scheme’s tenure.

The financing limit for a property is up to 90% of the value of the property.

Notably, the eligible properties under this scheme are valued at not more than RM500,000 at point of primary offering.

They are completed residential properties located within Malaysia with valid certificate of completion and compliance and valid and effective legal title with no encumbrances attached.

As for the property crowdfunding (PCF) operator, the platform must be registered with a recognised market operator and have a minimum shareholders’ fund of RM10 million, of which RM5 million must be set aside and maintained in a segregated account at all times.

The RM5 million set aside shall only be used for the purpose of ensuring and facilitating the exit certainty.

Source: EdgeProp.my