Proper studies needed on property crowdfunding

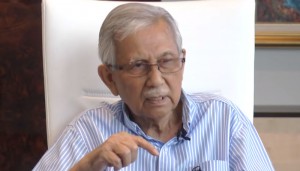

The government has good intentions in introducing the property crowdfunding initiative, the first such financial innovation in the world, but proper studies need to be carried out, said the Council of Eminent Persons chairman Tun Daim Zainuddin.

The government has good intentions in introducing the property crowdfunding initiative, the first such financial innovation in the world, but proper studies need to be carried out, said the Council of Eminent Persons chairman Tun Daim Zainuddin.

He said the peer-to-peer (P2P) home financing initiative, announced by Finance Minister Lim Guan Eng during the 2019 Budget tabling recently, was something new.

“It’ll be the first time a country is attempting this to help bridge the gap between low wages and high housing prices.

“So we should see more studies being carried on practical ways to implement this,” he told reporters on the sidelines of the Affin-Hwang Capital Conference Series 2018 here today.

Earlier this week, Prime Minister Tun Dr Mahathir Mohamad expressed confidence that the property crowdfunding solution would help drive the building of one million houses over 10 years.

The scheme, to be regulated by the Securities Commission, will offer first-time house buyers the chance to pay only 20% to own a house while the remaining cost will be borne by investors via a P2P financing framework.

When tabling the budget last Friday, Lim said the first exchange was expected to go live in the first quarter of 2019.

Commenting on the Japanese government’s offer to guarantee the 200 billion yen (RM7.4 billion) Samurai bonds with a 10-year tenure, Daim said it would help Malaysia to retire some of the old debts that were signed on at high interest rates.

Source: Bernama