Is the freeze on high-rise residences above RM1m warranted?

by Previndran Singhe

by Previndran Singhe

I must applaud the Malaysian government’s responsiveness in trying to manage the perceived property bubble, with specific focus on the residential luxury market.

When we were in university, we were told that a property bubble is usually preceded with what one calls an euphoria of buying, demand exceeding supply and banks taking massive mortgage risks. Technically, there should also be a marked increase in property prices in the preceding years — all of which is missing in our current situation.

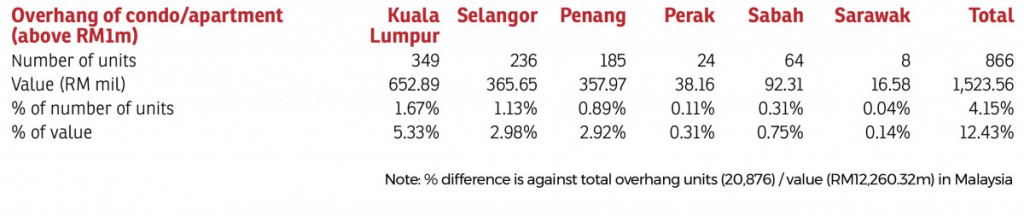

With the help of information from the National Property Information Centre (Napic), we have tried to analyse this perceived threat from high-rise properties of above RM1 million.

Firstly, in Kuala Lumpur, the total value of the overhang in this category is a mere RM652.9 million. This is just 5.33% of the total overhang value recorded in the entire country!

In fact, the overhang value of high-rise residences nationwide of above RM1 million, compared with the total RM12.26 billion residential overhang in the whole country, is only RM1.5 billion or 12.43%.

In terms of volume, high-rise residenital units of RM1 million and above make up just 4.15% of the total overhang. The balance 95.85% is the problem.

Interestingly, Johor has no overhang of high-rise condominium units of above RM1 million despite a massive residential overhang worth RM3.8 billion, which is about 30% of the total national overhang value.

The state’s overhang of residential properties of above RM1 million — which are all landed properties, mind you — is worth RM1.18 billion, with the majority being 2- and 3-storey semi-detached houses.

Delving into the Napic data further, one begins to realise that the overhang in high-rise residential properties of above RM1 million is predominantly found in six states, namely Kuala Lumpur, Selangor, Penang, Perak, Sabah and Sarawak, with the former three recording the highest amount of overhang.

To tackle the property overhang in the country, I would propose that each state break down the data to see which property segment has the highest overhang and which is having difficulties in being disposed.

This can assist the market to move these particular segments faster while working with the developers or the stakeholder to ensure so.

For Johor in particular, I would encourage developers to release the said unsold semidee units with special promotions. It would also be good if the government could assist in terms of reduced stamp duty or other tax breaks to the developer, benefits which could be transfered to the buyers in this category.

To have restrictive blanket bans on the development as the government has recently imposed on certain properties, without a proper analysis of the right information (we are relying on Napic), may cause a market imbalance in future.

As one of the growing nations in Southeast Asia, high-rise development is the way to go in urban locations — and with land prices rising, it will be counterproductive to have such a policy.

– Previndran Singhe

The CEO and founder of Zerin Properties.

Source: EdgeProp.my