Property transaction fees up

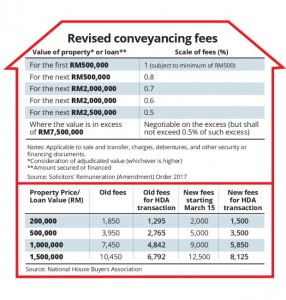

The sale and transfer of property valued at RM500,000 and below will now be subjected to a 1% conveyancing fee.

The sale and transfer of property valued at RM500,000 and below will now be subjected to a 1% conveyancing fee.

Taking effect today, it came about with the revision of the fee structure in the Solicitors’ Remuneration Order by the Bar Council last year.

The revision, which was approved by the Solicitors Cost Committee on Feb 28, will also see 0.8% conveyancing fee for properties worth above RM500,000 but below RM1mil.

Previously, only properties worth RM150,000 and below were subjected to a 1% fee while those costing above RM150,000 and up to RM1mil were imposed with a 0.7% charge.

However, like the old Order, property transactions from licensed housing developers will automatically get between 25% and 35% reduction in fees depending on the value.

This means that for a property worth RM500,000, the new conveyancing fee is RM5,000 but will only come up to RM3,500 following reductions. In the past, the fee was RM2,765.

For a RM1mil property, the fee is RM5,850, up from RM4,842.

According to the association, the sum is calculated by charging the 1% fee on the first RM500,000 before adding the 0.8% fee on the subsequent value. This total is then deducted with the 35% reduction.

Before the revision in March last year, the fee structure had remained the same for the past 11 years.

Bar Council’s conveyancing committee co-chairman Datuk Roger Tan said the revision was “minimal” considering the accumulated inflation in the past decade.

“The changes are minimal and reasonable,” Tan told The Star.

He said it was difficult to find a house worth RM150,000 nowadays, adding that most now sold for at least “half a million ringgit”.

This, said Tan, was the basis for raising the bar for the 1% fee from RM150,000 to RM500,000.

“Even affordable homes now cost around RM300,000,” he said. The previous amendment to the Solicitors’ Remuneration Order was made in 2006.

A calculation by the association also showed that with the revision, conveyancing fees were expected to rise between 8.1% and 26.6% depending on the value of property transaction.

However, this was still lower than the accumulated inflation, which, since 2006, had amounted to at least 33%, said its honorary secretary-general Chang Kim Loong.

“We are of the opinion that the increase in legal fees under the Order for sale and purchase, and loan agreements are still reasonable and justified, taking into consideration the rising costs of living and doing business since 2006,” he said.

Chang said he did not expect the slight rise to set off a “domino effect” on living costs or house prices.

“Most people can only afford to buy one property in their lifetime. A small minority may be lucky enough to afford a second property for long-term investment.

“Such a one-off increase is not expected to impact living expenses every day compared to, say, increase in toll or utility charges which are incurred on a daily basis,” he said.

In Malaysia, both buyers and sellers in a property transaction pay the conveyancing fees to their own lawyers.

However, in some cases where the buyers do not have their own lawyers, the property developers will offer to absorb the costs.

Source: TheStar.com.my