EcoWorld sees property market improving in 2017

Premier lifestyle developer Eco World Development Group Bhd (EcoWorld) is optimistic about the overall property market this year, which it expects to improve, partly anchored by factors that include low interest environment and positive buying sentiment.

“I acknowledge that the property market is still challenging. But this year is going to be a positive year, as compared to last year. Despite volatilities from the goods and services tax, we still managed to garner good sales.

“This year, we are confident of achieving our sales target of RM4 billion,” its chief executive officer Datuk Chang Khim Wah (pictured) told reporters, after the company’s extraordinary general meeting here today.

In the financial year ended Oct 31, 2016 (FY2016), EcoWorld clocked in RM3.8 billion sales, with unbilled sales at RM4.9 billion. To date, the group’s unbilled sales, inclusive of subsidiary Eco World International Bhd’s numbers, is at RM6 billion.

“The low interest regime is stable and attractive for the current property market for now,” he added. Currently, Malaysia’s interest rate level, as measured by the overnight policy rate, stands at 3%, after Bank Negara lowered it by 25 basis points on July 13, 2016.

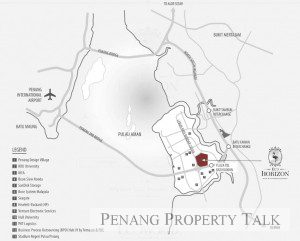

This year, Chang said EcoWorld will be focusing on 17 of its core developments projects that spans across three growth areas: Penang, Klang Valley and Iskandar Malaysia in Johor.

“We have our hands full with the current projects and that is going to keep us busy for this year,” he said, adding that for now, Eco World has no plans to make a foray into Sabah and Sarawak.

EcoWorld is currently developing some 8,052.7 acres of land, with total gross development value (GDV) of RM87.5 billion. Its undeveloped landbank stands at about 5,500 acres, which an estimated GDV of RM77.5 billion.

“If we are to acquire and replenish more of our landbanks, the price has to be right and the location has to make sense. The land must be situated closer to highways,” Chang said, adding EcoWorld is always on the lookout for exciting opportunities.

On gearing, EcoWorld chief financial officer Datuk Heah Kok Boon said it is still accomodative and relatively stable for the company at the moment, but Eco World is always mindful of it and that it will pare down debts to ensure a healthy balance sheet.

“We will always ensure that our debt and gearing level will be at a comfortable level to ensure the sustainability of our financial position. As and when the need arises, we might want to either gear up or gear down, but we must do it cautiously to ensure that our financial health is always at an optimal level,” Heah added.

As at end-Oct 2016, Eco World’s total interest-bearing borrowings stood at RM2.86 billion, equivalent to 0.76x or 76% in gearing ratio.

Meanwhile, Chang was tightlipped when asked about speculations that Eco World was in talks over a potential merger with Sime Darby Bhd’s property arm.

“No comment,” he said, adding that EcoWorld “does not comment on rumours and market speculation.”

Source: TheEdgeProperty.com.my

EcoWorld is the best bet for number one property investment and quality