Penang’s landed housing market stays firm

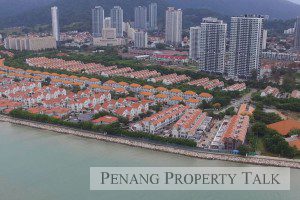

With the preference for landed homes among homebuyers in Penang, the landed residential property segment in the state is expected to remain firm, according to CBRE|WTW Penang.

With the preference for landed homes among homebuyers in Penang, the landed residential property segment in the state is expected to remain firm, according to CBRE|WTW Penang.

“As of 3Q2016, the existing supply of landed homes in Penang stood at 150,307 units, of which 75% were on the mainland. New supply that came into the market in the first nine months of 2016 was 3,877 units where 92% of them are on the mainland,” said CBRE|WTW Penang director Peh Seng Yee at the launch of the consultancy firm’s “2017 Asia Pacific Real Estate Market Outlook: Malaysia” report on Jan 18.

According to the report, new products that entered the Penang island market were targeted “towards niche and high-end market that the new landed homes launched on Penang island in 2016 came with prices that are generally driven by high land cost and land scarcity”.

Peh noted that most were priced at more than RM1.6 million per unit.

On the Penang mainland, the report stated that newly launched landed homes (2-storey terraced and semi-detached homes) there have posted higher prices (RM400,000 and above) than the general sub-sale market while subsale 2-storey terraced houses and semi-detached homes had observed marginal growth of up to 5% in 2016.

“Landed homes in Seberang Perai Tengah commanded the highest transacted prices ranging from RM520,000 to RM535,000 for a double-storey terraced house on the secondary market.

“Similar homes in Seberang Perai Selatan were transacted between RM380,000 and RM410,000 while in Seberang Perai Utara, the transacted prices were between RM300,000 and RM360,000,” said CBRE|WTW in the report.

High-rise homes

Meanwhile, on the state’s non-landed residential property market, Peh said it will continue to be a buyers’ market as demand has somehow lost its momentum with more new supply coming in over the next few years.

On the mainland, new high-rise residential developments continue to be concentrated in major towns such as Butterworth, Seberang Jaya and Bukit Mertajam, with some in upcoming growth areas such as Simpang Ampat, Bukit Tambun and Batu Kawan.

“Also, tight lending rules have led to greater difficulties in accessing loan financing,” Peh said. The total supply of high-rise residential property in Penang stood at 54,619 units, with 86% of them located on the island, he added.

In the sub-sale market, condominiums in prime locations on the island were transacted between RM650 psf and RM750 psf in 2016. On the mainland, the average transacted price for high-rise residences is about RM380 psf.

Peh commented that the prices of sub-sale high-rise residential units are “sustainable, with stagnant or minimal price growth of up to 5% expected”.

Commercial/Office market

Meanwhile, the demand for purpose-built office (PBO) space in Penang is expected to remain stable, with a bit of improvement in the near future as the state lacks new prime office space.

“New take-up for PBO is expected to be primarily in newer and well-maintained buildings and future developments are likely to shift towards the south-eastern portion of Penang island,” said Peh.

He said the current total supply of PBO in Penang is about 11.98 million sq ft of which 75% is on the island. The overall occupancy rate for office space in Penang is 83%.

Meanwhile, the office space market in Seberang Perai has been stagnant over the past year as many small and medium-sized local companies prefer to purchase or rent shophouses in commercial locations.

Source: TheEdgeProperty.com.my