Property sales dipped further in first half of 2016

Market performance remained sluggish in the first half of this year as property transaction numbers in the country continued their downward trend.

Market performance remained sluggish in the first half of this year as property transaction numbers in the country continued their downward trend.

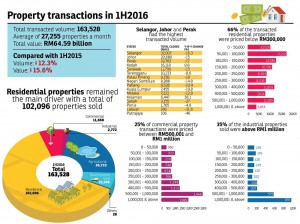

According to the National Property Information Centre’s (Napic) data for 1H2016, a total of 163,528 properties were transacted averaging 27,255 properties a month, a decrease of 12.3% compared to the same period last year.

In terms of transacted value, the total dropped to RM64.59 billion in 1H2016 from RM76.61 billion in 1H2015.

Among all the segments, residential properties remained the main driver, constituting 62% of total transactions. In 1H2016, a total of 102,096 residential properties worth RM32.7 billion were sold. However, compared with 1H2015, the transacted volume and value for the residential segment had dipped 14.5% and 10%, respectively.

Interestingly, agricultural land emerged the second biggest contributor to total transaction volume in 1H2016 at 23%. There were 36,723 land deals worth RM6.33 billion sealed during the period. Compared with 1H2015, the transaction volume and value had increased 7.3% and 4% y-o-y, respectively.

Meanwhile, development land took up 6% with 10,249 deals worth RM8.56 billion, down 5.34% in terms of volume and 28.8% in value from a year ago.

The third most transacted property type was commercial properties. At 7%, it saw 11,660 properties sold in 1H2016 at a total value of RM11.32 billion. However, its transaction volume and value had dipped significantly by 34.5% and 21.85%, respectively, from the same period a year ago.

Selangor, Johor and Perak ranked top three

Of the various states, Selangor, Johor and Perak held the highest transaction volume in 1H2016 — remaining unchanged from 1H2015 — while Putrajaya, Labuan and Perlis recorded the lowest transactions in the same period among the 16 areas shortlisted by Napic. Selangor saw 32,007 properties worth RM18.2 billion sold in 1H2016, with the highest number of transactions coming from residential properties at 24,839, commercial properties at 2,719 and agricultural land at 2,059.

Johor was ranked the second highest state with 20,680 properties sold, which carried a total value of RM10.87 billion in 1H2016. Residential properties, agricultural land and commercial properties were the most traded segments in the state with transacted cases of 13,693, 4,242 and 1,583, respectively.

Perak, ranked third in terms of transaction volume, saw 19,782 properties worth RM3.9 billion sold in 1H2016. Residential properties and agricultural land were the most transacted segments in Perak with 11,965 and 5,944 deals closed, respectively.

However, the top three ranking states saw decreasing sales. Transactions in Selangor, Johor and Perak dipped 16.3%, 15% and 17% y-o-y in 1H2016.

On the other hand, Kedah and Kelantan have seen a significant increase in transaction volume.

Transacted properties in Kelantan totalled 6,447 cases, an increase of 38% y-o-y. Agricultural land and residential properties were the most transacted segments in Kelantan with 2,871 and 2,656 deals respectively, in 1H2016.

Kedah’s total transacted properties had surged 9.8% to 16,118 cases, with the highest number of transactions coming from the residential segment at 11,965 and agricultural land at 5,944.

Buyers looking for affordable properties

According to Napic’s data, 66% of the total transacted residential properties in the country were priced below RM300,000. Transactions of residential properties between RM300,001 and RM1 million stood at 30%, while houses with price tags of over RM1 million and above hit just 4%.

On commercial properties, 36% of transactions were for properties below RM300,000. Most transactions were for properties with price tags between RM500,001 and RM1 million. Properties with selling prices over RM1 million stood at 17%.

For industrial properties, 44% of the properties sold were below RM500,000 while 35% were closed at RM1 million and above.

The data also showed that 84% of the agricultural land were transacted below RM200,000 and most deals (46%) were sealed at below RM50,000.

Under development land, the performance was similar to the agricultural land segment, where 62% of the deals were below RM200,000, while 30% of land plots transacted were below RM50,000. However, 12% of the transactions were priced above RM1 million.

Source: TheEdgeProperty.com.my

This will be the longest property recession in Msia history. Before things start to look a little bit brighter, there will be a prolonged stagnation. For those who are genuinely looking for a property for own residence, hang on for a while, there will be plenty of good bargains coming up end of next year.

No. You are wrong. We can’t stop buying. Once everyone stop buying and definitely the money will stop flowing into the market. This is will make the market more worst. Everyone need to spend to make this market alive and everyone will earning. The more the merrier.

@Daniel

That’s why you have the up and down cycle. During the up cycle, everyone has the reason and means to buy, while during the down cycle, everyone has plenty of reason to wait, and most of all, no means to buy. Therefore, the ups and downs are unavoidable, it’s natural, it’s human nature, don’t fight it, just have to understand it.

Checked several projects, all seem to not giving any much discount fr original sale price. I dun free this that, I want price cut la.

@behck

Don’t worry, this is not the time to buy yet, but you can shop around, see see look look new projects and resale market, BUT don’t buy yet, unless you are so lucky to find a good bargain so soon.

You all have to start buying now, please don’t wait anymore. Once economy are recover and the price will shoot up immediately. Your plan can’t catch up the change.

malaysia depends alot on oil price . do you see that oil price will go up next year ? if oil price stagnant , economy stagnant, people no money to throw at developers

now , borrow money from export import bank of china to build railway track to east coast

can consider it as “borrowing” long term loan laa …. need to re-pay with interest for many many years … those that will have money to throw at developers will be working on this project ( unless the chinese contractors are allowed to import 100% of their workers , 100% of equipment , 100% of raw materials all from china) . Then , they only need to buy Malaysian food to eat ..haha .. kesian

just wait economy crisis like year 2009, wait investor cant hold anymore they will let go original price or lower, that time bayswater market price around 500k but owner let go urgently with price 350k only, I bought at that time and bank loan interest only 3.8%

@waterfish

Actually for this time, there’s no need economy crisis, as the state is trying to implement more policies to make sure the market is flushed with more properties at low price by building more and more affordable homes. Stay tuned, there’s more to come!! Good luck!

yes, agree… there will be more properties with good bargain coming next year… just wait…seriously now the properties are over price especially Penang one…