A maturing housing market

The Penang housing market is maturing, says Michael Geh, director at Raine & Horne International Zaki + Partners. The data shows that in the third quarter, properties in the secondary market showed little price movements, compared with the previous quarter and the year before.

The Penang housing market is maturing, says Michael Geh, director at Raine & Horne International Zaki + Partners. The data shows that in the third quarter, properties in the secondary market showed little price movements, compared with the previous quarter and the year before.

“I would consider this a mature market, where there is less speculation,” Geh says in presenting the 3Q2016 Penang Housing Property Monitor. Besides that, downward pressures that do not seem to be weakening continue to plague the market.

The primary or developers’ market has been hindered by the persistent and unusual delay in receiving the advertising permit and developers’ licence or APDL. Geh estimates about 50 developers, with a total of 100 projects, are unable to get their projects off the ground.

In the secondary market, the difficulty in getting loans is contributing to a slowdown. Banks are still giving out loans but no longer at 90% of the value of a property that people had got used to.

Because of these reasons, Geh forecasts that the steady decline in Penang’s transactions and property values will be evident in the second half. Based on data from the National Property Information Centre (Napic), he believes transactions in the primary market will come up to about 640, with a value of RM430 million. This is a far cry from the 2,254 transactions in 2H2014, for a value of RM1.03 billion.

The actual figures have yet to be released by Napic.

Meanwhile, the closure of budget hotels, guesthouses and hostels, many of them set up in prewar shophouses within the George Town heritage zone, has made the headlines. The reason is because owners are not able to comply with the state government’s stringent licensing requirements.

“Prewar shophouses in the heritage area that were converted into budget hotels apparently flouted certain rules, regulations and guidelines set by Majlis Bandaraya Pulau Pinang (MBPP),” Geh explains.

Will this lead to owners selling their properties to foreign buyers who have been snapping up prewar shophouses of late?

Geh does not believe so. The handbrakes were pulled on the purchase of such units following the news that the state government was considering resurrecting rent controls. For the moment, foreign buyers are taking a wait-and-see stance, he says.

The proposed rent control was in response to the eviction of tenants at an alarming rate in these buildings by the owners.

The state government is now thinking of introducing a Rent Regulation Act instead to manage the situation, according to Geh.

“Currently the state is getting feedback from stakeholders on whether it is a good thing to introduce such an act. This is an ongoing process,” he says.

While Geh understands the need for entrepreneurs to comply with regulations, he believes that more thought has to be given on how to maintain George Town’s heritage structures and promote entrepreneurship at the same time.

The initial proliferation of budget hotels, he points out, was a response to the increase in tourist arrivals after the island gained its Unesco World Heritage status.

“It is an important matter for property owners to be able to use their property for economic returns. I believe we should have a compromise on this issue,” he says.

“There is a big clash now because hotel owners and their associations are very influential. They say they are complying with the guidelines stipulated by the state, but what about the budget hotels?

“So the MBPP is slapping the property owners, whether you are a four-room, 10-room or 50-room operator, with the same standards as a 200-room operator.”

“Over-enthusiastic heritage activists”, he claims, are also putting a lot of restrictions on what one can do with a heritage site, so much so that doing business become unviable.

“I believe that there must be a balance between conservation, economic viability and being business friendly,” he says. “A lot of people who buy prewar shophouses to operate budget hotels are not foreigners but locals who see an opportunity. I believe the state of the inner city is evolving and our town council has been over-influenced by heritage activists to maintain the status quo. I feel this is wrong. There are better ways to handle it,” Geh says.

“I remind everyone that George Town was a trading hub and a business outpost. Activists are imposing many things that stifle business. To me, it is unhealthy and there must be a balance.”

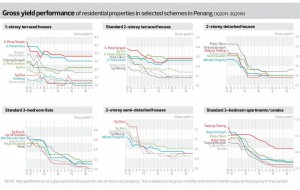

Slight movement in house values

For 1-storey terraced houses, only those in Jelutong saw price movement from the quarter and the year before, rising 1.11% to RM910,000.

Two-storey terraced houses experienced minimal price movements. Houses in Green Lane rose 4.17% from the previous quarter and the year before to RM1.25 million. In Pulau Tikus, prices increased 6.67% to RM1.6 million from the previous year.

As for 2-storey semi-detached houses, quarterly results remained unchanged for all houses in the survey. The prices of semidees in Sungai Dua and Minden Heights rose 6.67% to RM1.6 million year on year, and by 2.78% to RM1.85 million in Sungai Nibong. In Island Park, prices went up 2.27% to RM2.25 million.

Two-storey detached houses also showed no price increase from the previous quarter in all areas surveyed. Houses in Island Glades rose 3.57% to RM2.9 million from the year before; Tanjung Bungah was up 2.7% to RM3.8 million; and Pulau Tikus saw a 2% rise to RM5.1 million.

For standard 3-bedroom flats, there was no change quarter on quarter. Flats in Bandar Baru Air Itam climbed 9.09% to RM240,000; Sungai Dua and Lip Sin Gardens rose 8.57% to RM380,000; Paya Terubong was up 5.88% to RM180,000; and Green Lane went up 5.26% to RM400,000. Flats in Relau remained unchanged.

For standard 3-bedroom apartments/condominiums, there was no price increase from the previous quarter for all areas in the survey. Year on year, units in Batu Ferringhi increased 2.22% to RM460,000; Pulau Tikus rose 6.15% to RM690,000 and Island Park/Glades was up 4.17% to RM500,000.

Read source: TheEdgeProperty.com.my