Condos in Penang that are flourishing

Despite the sluggish market, property investors in Penang can take comfort in reports of capital appreciation in the state. Data collected by the National Property Information Centre’s (Napic) Property Market Report 2015 showed that out of 30 condominium projects in Penang, 11 saw price increases from 2014 to 2015.

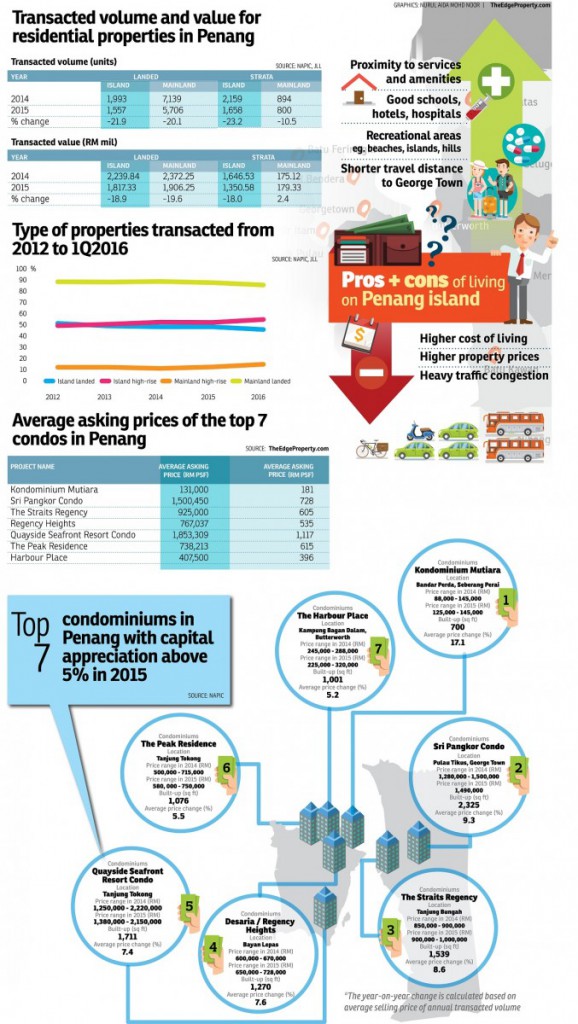

Of the 11, seven recorded price growth of over 5% year-on-year. The seven were Kondominium Mutiara (17.1%), Sri Pangkor Condo (9.3%), The Straits Regency (8.6%), Desaria or Regency Heights (7.6%), Quayside Seafront Resort Condominium (7.4%), The Peak Residences (5.5%) and Harbour Place (5.2%). The transacted prices of these condominiums ranged from RM125,000 to RM2.15 million. All of them are located on Penang island except Kondominium Mutiara and Harbour Place.

Of the two projects on the mainland, Kondominium Mutiara recorded the higher price growth at 17.1%, where its unit price range of between RM88,000 and RM145,000 in 2014 had gone up to between RM125,000 and RM145,000 in 2015. This condominium also took the top spot as the project with the highest price growth in Penang overall.

These two projects have their respective pull factors that have contributed to their price growth. “Kondominium Mutiara is located less than 5km from Universiti Teknologi Mara (UiTM), so the main occupiers are students. The units there are priced below RM150,000 and there are no other similar properties in that area,” Henry Butcher Malaysia (Penang) Sdn Bhd senior vice-president in asset valuation Shawn Ong Kah Boo offers.

Harbour Place, which is located in central Butterworth, is less than 2km from the ferry terminal. Based on Napic’s data, Harbour Place was transacted between RM225,000 and RM320,000 in 2015, which Ong says is a very attractive price range for the younger generation of homebuyers.

JLL Malaysia country head YY Lau believes that the more affordably priced non-landed homes on the mainland have attracted the locals considering how affordability has become a major concern among homebuyers. “The supply of condominiums and apartments priced below RM500,000 on Penang island is limited. Looking at the price trends of between RM1 million and RM2 million of new condominiums launched on the island, it’s easy to deduce why buyers are looking for alternatives on the mainland,” says Lau.

“Problems in obtaining housing loans could have also pushed more buyers to opt for units which are considered affordable to them,” she adds.

Over on the island, the highest price growth was recorded at 9.3% at Sri Pangkor Condo. The condo is situated at Pulau Tikus with George Town city centre only less than 3km away, not to mention accessibility and amenities such as shopping malls, hospitals and schools located nearby.

Ong notes that new condominium launches usually benefit older ones as consumers look for alternatives against the higher-priced new condominiums, citing Regency Heights as an example.

“New developments are coming up nearby and have created a pull factor for Regency Heights, improving its asking price although it’s not situated in George Town and is nearly 10 years old,” he says.

Oversupply in island’s condo market?

Henry Butcher’s recent research report, Penang real estate market: Opportunities despite weak sentiments for 2Q2016, stated that as at 2Q2016, Penang island has an existing residential supply of 217,467 units which comprises 42,781 units of landed houses and 174,686 units of strata properties. On the mainland, the existing residential stock stands at 185,027 where there are 111,413 units of landed houses and 73,614 units of stratified units.

“The number of new completions in 2014 on the island was 4,991 in contrast to completions in 2013 totalling 2,926. The surplus could have been carried forward to 2015, resulting in oversupply,” Lau offers.

Ong also foresees significant new supply dampening the condo market in Penang island. “There is still a lot of supply coming in over the next few years and it will continue to be a buyers’ market for condominiums on the island,” he says.

In terms of future supply, supply of landed and strata properties is estimated at 11,391 units (up to 2018) and 55,445 units (up to 2019), respectively.

Despite the concerns of oversupply in the condo market on Penang island, the overall demand for non-landed homes in Penang has been gradually rising. “There used to be more landed residential property transactions on Penang island than high-rise ones but the percentage of non-landed housing transactions surpassed landed homes in 2013,” says JLL’s Lau.

According to Napic’s data, 48% of the transacted residential properties on Penang island in 2015 were landed homes. By 1Q2016, the transacted figure for non-landed homes on the island had risen to 55% while on the mainland, more than 80% of transacted properties were still landed homes.

However, “we can see demand for high-rise residential properties in Penang as a whole is increasing. Moving forward, we expect to see further interest in high-rise residences due to the additional facilities, services and security provided by condominiums compared to landed housing,” Lau elucidates.

Mainland vs island

Meanwhile, director of Penang-based Izrin & Tan Properties Sdn Bhd Tan Chai Liang says that as land prices continue to spike, future developments on Penang island will most likely be non-landed schemes.

Tan believes that the island is still the preferred choice for most homebuyers, despite its decreasing affordability.

“The main issue here is the affordability of new homes and this may drive away some new homeseekers to go for lower-priced and larger homes on the mainland. However, the mainland is lacking in terms of services and amenities. Penang island still has the upper edge with its international schools, good private hospitals, colleges and hotels,” he says.

Tan also notes that compared with the non-landed housing market on the mainland, condominiums on the island had a head start in terms of price growth, having recorded capital appreciation as early as 2000, compared to the ones on Penang mainland.

“Condos and apartments on the mainland may have recorded higher capital appreciation by percentage recently but in terms of price psf, prices are still low compared to their peers on the island,” he adds.

There is no doubt that the island offers more in terms of amenities. It also has easily accessible recreational areas like scenic beaches and hills.

On the downside, Lau says people living on the island have to go through traffic congestion as both recreational and eateries on the island are popular not just among Penangites but international and domestic visitors.

Catalysts in Penang

Both the mainland and island have undergone major transformations over the past few years.

“We see economic activity and housing projects mushrooming in Batu Kawan (mainland), Bukit Relau, Batu Maung, Sungai Ara and Teluk Kumbar (island), capitalising on the completion of the Sultan Abdul Halim Muadzam Shah Bridge (previously known as the Penang Second Bridge) in 2014,” says Lau.

Following this, the next major infrastructure developments which are being pursued by the state government would be the proposed Penang Light Rail Transit (LRT) Line connecting Komtar and the Penang International Airport and the proposed undersea tunnel linking Gurney Drive (island) with Bagan Ajam (mainland). If these projects are realised, they can become catalysts for the future growth of the real estate sector in Penang.

Source: TheEdgeProperty.com.my

stay 300k condo but paying maintenance. up and down stair making noise problem etc ….

better spend 400k with a land.

Please dont mislead people with this image.

From Seberang Perai/BM to komtar is nearer that from Batu Feringgi/Teluk Kumbar/Balik Pulau to Komtar

Please pm for details

PM to where? Timbuktu ah?