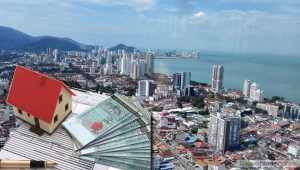

Ministry mulls proposal for developers to act as money lenders

The Urban Wellbeing, Housing and Local Government Ministry is mulling a proposal for housing developers to be issued a money lending licence to help non-bankable house buyers and overcome down payment issues.

The Urban Wellbeing, Housing and Local Government Ministry is mulling a proposal for housing developers to be issued a money lending licence to help non-bankable house buyers and overcome down payment issues.

Tan Sri Noh Omar (pix), the Minister, said he observed many buyers having difficulty making down payments.

“I am thus proposing that eligible housing developers, especially those with deep-pockets like Sunway Group, EcoWorld, Mah Sing and Glomac, be issued a money lending licence.

“It will be restricted to only providing end-financing to eligible house buyers who face difficulty in securing loans from banks,” he said in his keynote address before launching the 19th National Housing and Property Summit, here today.

The minister said the proposal is a win-win situation for both developers and house buyers.

“For the developers, this end-financing facility offers a second profit centre after the sale of the houses,” he added.

Noh said another new initiative recently approved by the government is the “Rent To Own” or R2O, for all eligible buyers of the People’s Housing Project scheme.

“With the introduction of this new R20 initiative, I hope we’ll be able to resolve the long outstanding problem of non-bankable house buyers, whose income may not meet strict bank requirements,” he added.

Meanwhile, at a press conference, Noh said interested developers can start to submit an application for the money lending licence, under the Money Lender Act (Revised 2011) or Act 400 under the purview of the ministry.

He said with a money lending licence, developers can assist buyers for 100% or partial financing, while the interest rate should not exceed 18% per annum.

Source: Bernama

Why Setia not in list?

Developer wont take such risk. Bank already reject this group. So developer will fund this high risk group?

U really need to think serious when investing property now.

can do like this? example bank only release 70% loan, another 30% loan from developer, In case owner cant hold, bank take the unit for auction? 30% of auction price pay to developer?

There must be good reasons why banks rejected certain applicants, by allowing developer to lend money to this people will not do anyone any good. If this go ahead, I think we are going to see many cases bankruptcy and foreclosure soon

This is not good at all. Very dangerous, opening up more loop holes for speculators.

Hopefully developers give 50 years tenure with super low interest… Then house price will continue to shoot up…

This will only lead to even more speculative buying and house prices are going to shoot up.

Banks are more careful when they lend money, because they are essentially paying the housing developers on behalf of the house buyer. Developers walk away with the money. If the house buyer defaults and cannot pay back the money, the bank is unable to recover the money. Hence there are cases when banks refuse to lend money because the property price is overvalued and banks only willing to lend like 70% of the price stated. In such setup, banks have the incentive to do a due diligence on the actual value of the property.

Now with this new setup, the developers are essentially paying money to themselves under the guise that they are ‘helping’ the house buyers. If the house buyer defaults, the developer in practice loses no money. They just take back the property and ‘sell’ to another gullible buyer offering ‘free’ 100% financing. Under this system, the developer is actually incentivized to hike up property prices to as high as possible. They do not need to do any due diligence on the property value as the price is just a number on a paper. The ‘money paid’ goes from the left pocket into the right pocket of the developer.

@Investor

Don’t be so naive, you want 100 years also they will give you, as long as you get your children to shoulder the liabilities. This is going to be one tool for developers to hike price.

This is essentially a tool for developers to “print” money.

@Kta

I totally agree with you. It’s either,

(1) the Ministry is so brainless; or

(2) our economy is in such dire situation that the gov is willing to sacrifice the future hard-earned money of the middle class to bail out the property industry; or

(3) plain “money politics”.

*sigh* hopeless and speechless