Will 2016 fare better than 2015? What is the Opportunity vs the Risk?

* Article by Freemind Works *

The year 2015 has seen significant highlights in the property market.

The year started with the implementation of GST in April 2015. The predictions of frenzy buying before and after the GST did not come true. Majority of investors, instead, took a wait and see approach.

We then witnessed the oil prices dropped to historical low, and O&G companies started laying off people. Then China decided to devalue the Yuan to make its goods more competitive. Closer to home the Malaysian Ringgit depreciated alarmingly against the US dollar. Gloomy global economy outlook and local homeground political instability all added to the uncertainty in the market.

To know more about property outlook, please click >>>> http://bit.ly/stratagemspng

With all these negative news, it is no wonder many Malaysian’s confidence were shaken and not too eager to commit to a property, especially from a property investor’s point of view. And guess what, even the first time home buyer/owners are NOT buying? We know this because the rules for affordable housing (which was meant for first time home buyer) have been relaxed to the extend that non-first time home buyer are also eligible to buy.

Now, let’s change gear and look at data and ask the next big question – what is in store for us in 2016?

In overall, Penang’s performance was fair as compared to the other major property market i.e. Klang Valley and Johor Bahru according to Property Indicator by WTW Research (Figure 1). The Penang’s residential property prices is still on the uptrend while the residential property prices in Klang Valley and Johor Bahru remain flat. Point to note is that the declining prices for high rise residential in Johor Bahru is due to the over supply in the Iskandar region.

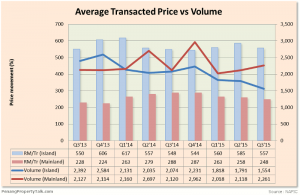

Now let’s focus on the performance of residential properties in Penang. Due to the various cooling measures implemented, challenging economic outlook and weakening sentiment, the Penang property market is not spared. This is demonstrated by the consecutive quarter-on-quarter decline in the residential property transactions since 2013 (Figure 2).

It was observed that the property transaction volume declined from Q3 2014 to Q3 2015 especially on the Penang Island. However, on the contrary, the value of properties have some how maintained or increase marginally, which means that the property prices on the island is still on the uptrend.

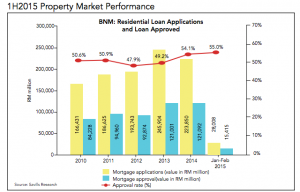

Adding to the current property market woes is the tight credit control environment. This has resulted in a high loan rejection rates from the bank, which forced many home buyers and investors at bay. According to a Savills Research (Figure 3), approximately 50% of loan application is rejected since year 2010.

Moving forward in 2016, the market sentiments will be no different from 2015. As long as the cooling measures remains and economic outlook is less than promising, the residential market will remain sluggish. And distressed.

As a property investor, how do we strategize for the year 2016? Notwithstanding the above, is the property market going to rebound and pick up again by 2016? Or even 3 years later by 2019?

For me, now is the good time to buy. Why?

In the current distressed market, there are opportunities to grab good deals. As a smart investor, look for bargains and below market value (BMV) properties. Individuals I am currently coaching found properties that is 20% – 30% lower than the market value. Essentially, these group of people will make money when they buy.

The market condition we are experiencing now is almost similar to the 2008-2009 sub-prime crisis in the year 2008 – 2009 crisis when the market was quiet and opportunities abound. Even property developers were more willing to offer low entry packages. I was reminded of the quote by Warren Buffet “Be greedy when others are fearful and be fearful when they are greedy”. But then, something is stopping you. What? Do you fear the uncertainty?

Then, what better way to counter that than to learn more and research more. Learn and research about the property market, do the math on the rental return and bang! You are ready to take on your next property.

I’m now a better investor than I was five years ago, all because I was ready to unlearn and relearn. I re-learned the fundamentals of property investment and used the no money down strategy.

And you are in a treat because for the first time in the Northern Region, all in one place, I have invited and assembled the best of the best Property Strategist and themselves Property Millionaires to share with you their view of the market in 2016 and the strategies to adopt for the year 2016.

If you want to get started on your property investment journey, is stuck (because of LTV) or uncertain how to proceed, then this is for you. If you are asking why your property loan is rejected or want to know how to still continue to get loans from the bank, then this is also for you.

This event is called the Property Strategems and will take place on Sat and Sun, 23 & 24 April, 2016 (2 full days) in Northam All Suites Penang. Seats are selling fast.

Quickly reserve your seats before it runs out:

>> http://bit.ly/stratagemspng

by Kaygarn Tan

Founder of Freemind Works, graduated with a Masters Degree from University of Science Malaysia. He started his property investment journey very early on, while still working in the corporate world. After sucessfully building a sizeable property portfolio using a tested and proven strategies, he decided to quit his day time job and go full time into property investment. He is now a Property Coach and as a testament to the strategies he used, he have personally coached hundreds of individuals to buy properties with profitable returns and generating positive monthly cashflow.

[Sponsored]