Half of overhang units are homes priced at RM300,000 and below

Deputy Finance Minister Datuk Chua Tee Yong expects the Malaysian housing property market to further soften this year. He sees developers focusing on the more affordably-priced homes. He is correct on both counts.

Deputy Finance Minister Datuk Chua Tee Yong expects the Malaysian housing property market to further soften this year. He sees developers focusing on the more affordably-priced homes. He is correct on both counts.

Speaking to reporters after launching the National Property Information Centre’s (Napic) 2015 Property Market Report on April 19, the deputy minister said the unsold housing stock – and by extension the country’s property overhang – could be reduced with fewer high-end homes launches.

Property overhang units must not be confused with unsold stock. The government has defined overhang units as properties that are completed and issued with Certificates of Fitness for Occupation (CFO) or Temporary Certificates of Fitness for Occupation (TCFO), but remain unsold despite having been put on the market for at least nine months.

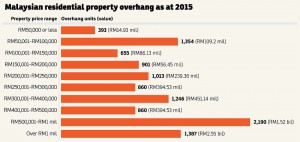

As at end-2015, Malaysia’s housing overhang units totalled 11,316 and these were worth RM5.9 billion, up by 16.3% in volume and 56% in value from those in 2014.

It would be simplistic to assume that the higher-end homes account for most of the country’s overhang units. Or that people are no longer interested in investing in more expensive homes.

Consider this – residential property priced at RM500,000 and more accounted for less than one third of the housing property overhang in 2015. On the flipside, houses that are priced at RM300,000 or less made up half of the overhang numbers. In fact, homes priced at RM100,000 and below accounted for about 15% of the overhang. (Refer to chart).

Of the total 3,577 overhang units priced at RM500,000 and above, Johor housed 930 units, Penang (705), Selangor (512) and Kuala Lumpur (422).

Why are the cheaper homes not selling? One would have expected these to be snapped up, right?

Poor take-ups for the low- and low-medium cost homes are nothing new. They have been subjects of debate and discussion in the property fraternity for years.

Issues hampering sales would include that of inconvenient location, lack of accessibility and unsuitable design of the product. The inability to secure end-financing is another main problem.

As for the overhang of higher-priced homes, developers have pointed to the Bumiputera quota.

Land is a state matter. The Bumiputera quota varies not just from state to state, but also between zones in a state. For instance, in Melaka, the city centre has a quota of 40% while outside the city, it is 60%.

In Selangor, the quota can go up to as high as 70% while in Johor, it is 40%. In KL, it is 30%.

Bumiputera units that are unsold can be released from the quota – meaning they can be sold to non-Bumiputeras – but the process varies from state to state, entailing differing durations and payments to the respective states.

Clearly, the implementation of a structured and transparent release mechanism for all Bumiputera units would help reduce the overhang of the upper-mid and high-end homes.

There must be a will to clear the overhang units – and the answer does not lie with just reducing supply.

Source: TheEdgeProperty.com.my

No comments