Penang Property Market Outlook (H2) 2015

Volume of transactions is expected to decline in Penang, says Henry Butcher Malaysia (Penang)

Key Economic Indicator

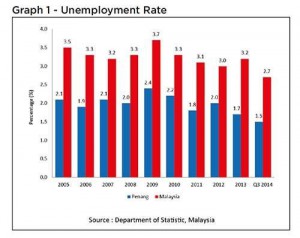

Penang’s Gross Regional Product (GRP) was mainly contributed by the manufacturing and services sectors. Manufacturing accounted for 50% of the GRP shares while 46% was from the services sector. Manufacturing’s main sub-sectors include electrical and electronic while services include hospitality, medical tourism and outsourcing of support services. The services sector is expected to surpass the manufacturing sector soon and is projected to grow by 48.6% in 2015. Unemployment rate remained stable at less than 3%. Penang’s population stands at 1,638,400 as at 2013 and two thirds of Penang’s population is less than 40 years old.

Impact of Goods & Services Tax (GST)

Impact of Goods & Services Tax (GST)

Goods & Services Tax (GST) under the Budget 2014 which replaced Sales Tax Act 1972 was implemented on 1st April 2015. The sale, purchase and rental of residential properties will not attract GST. However, any sale, purchase and rental of commercial & industrial properties will be taxed at 6%. Under the GST tax regime, consumers have been paying more for food, products and services. In view of the overall cost increase in property development, most analysts are of the opinion that this will have an eventual impact on property prices in the primary market. Commercial properties which attract GST are now beginning to feel the brunt of its effect.

Base Rate

Effective from January 2015, the new reference rate is known as Base Rate (BR). The latest BR as at Jan 2015 is between 2.96% to 4.02% while effective lending rate hovers between 4.45% to 4.8%.

Non-Performing loan

The percentage of non-performing loans (NPLs) reflects the health of the banking system. A higher percent of such loans means that the banks are having difficulty to collect their interest and principal on their credits. The total housing loan approved this year was RM1.937 million as at May 2015 compared to RM1.723 million during the same period in 2014, an increase of about RM214 million.

Read more here – iProperty Focus