Positive market sentiment to continue

An aerial view of Penang … high-rises in the state saw the most activity in the quarter under review, with prices increasing in all areas surveyed. Photos by Abdul Ghani Ismail

The Penang property market had an eventful first quarter, and the positive sentiments and values are expected to sustain, according to Raine & Horne International Zaki + Partners Sdn Bhd director Michael Geh. He attributes the upswing to the implementation of the Goods and Services Tax.

“In the first three months of this year, I saw people dashing to purchase a house from the primary market. As an observer of property fairs, I noticed that there was brisk business,” Geh says when presenting The Edge/Raine & Horne International Zaki + Partners Penang Housing Property Monitor for 1Q2015.

This observation, he adds, was confirmed by data from the National Property Information Centre (Napic), which was released recently. According to Napic, the primary market in Penang saw a 48.91% increase in total transactions to 4,095 last year, from 2,750 the year before. In contrast, the secondary market saw a 4.25% dip in transactions to 14,315, from 14,950 the previous year.

“Despite the loan rejections, I saw an upward trend last year and a continued upward trend of 3% to 5% in 1Q2015,” says Geh. Moving forward, he believes this trend will continue in the primary market, and expects to see another 5% increase in transactions.

He admits that he had been surprised to see the growth in the Penang property market, especially in the primary segment, despite the high loan rejection rate and restrictions in place.

“This is a significant trend,” Geh says.

One development that he believes will greatly impact the property market is the announcement of the Penang government’s plan for the light rail transit (LRT) alignment. To date, there are no details about the project but he is hopeful that it will be announced this year.

“The LRT is needed. This will be a game changer for Penangites,” he says.

As for the alignment, Geh believes the LRT will go through areas with a large population base. He thinks a good location for the main terminal would be somewhere near Menara Komtar, with a line passing through Jalan Dato Keramat and Jalan Air Itam, and then stopping at Jalan Paya Terubong.

He says the Air Itam valley — which has 30% to 40% of the island’s population — is the most populous area. A line along Jalan Kelawai, ending in Straits Quay, and one to the Penang International Airport would be good, he adds. He believes once the announcement is made, it will have an immediate positive impact on sentiments and property prices.

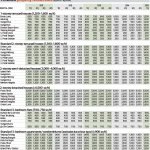

Terraced houses

For 1-storey terraced houses, the highest price gainers on the island during the quarter under review were those in Green Lane and Jelutong, both of which saw a 21.43% year-on-year increase to RM850,000 from RM700,000. On the mainland, houses in Seberang Perai Tengah rose 20% to RM200,000.

However, homes in Bandar Bayan Baru and Tanjung Bungah only rose marginally at 2% and 1.33% respectively. Geh explains that homeowners in these areas are just not selling.

Quarter on quarter, houses on the mainland saw a price increase, with those in Sungai Dua achieving the highest growth of 11.43% to RM780,000.

For 2-storey terraced houses, all areas surveyed experienced a price increase. Residences in Sungai Ara rose 26.67% y-o-y to RM950,000, followed by those in Sungai Nibong, which gained 25% to RM1.1 million. As for the mainland, Seberang Perai Selatan achieved the highest price increase of 27.27% y-o-y to RM280,000.

On a q-o-q basis, there were no changes seen in property prices, except for those in Pulau Tikus, which increased by 3.45%, and Sungai Ara, by 5.56%.

Semi-detached and detached houses

For the semidee segment, all areas saw a price increase. Houses in Island Park rose 27.91% to RM2.2 million from RM1.72 million a year ago. Those in Sungai Ara increased by 7.69%, Sungai Nibong by 6.06%, Sungai Dua by 7.14% and Minden Heights by 7.14%.

Q-o-q, only homes in Island Park (10%) and Sungai Ara (3.7%) saw price growth during the short time frame.

Meanwhile, a number of detached houses in the areas under survey saw price growth from the year before. Homes in Minden Heights saw a 25% increase to RM3.5 million, followed by those in Green Lane (16.67%), Tanjung Tokong (14.29%), Island Glades (12%) and Pulau Tikus (11.11%). Only residences in Tanjung Bungah showed no price increases, remaining at RM3.7 million since last year.

Geh explains that Tanjung Bungah is a mature neighbourhood with no available parcels to build on. Residents there are also not keen on selling their property. Nevertheless, like Damansara Heights in the Klang Valley, properties in Tanjung Bungah are much sought after.

In terms of quarterly results, there were no changes from the previous quarter.

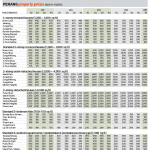

Flats and condominium units

High-rises saw the most activity in the quarter under review, with prices increasing in all areas surveyed — both in the yearly and quarterly results. Geh says this was “because more people on the island prefer to stay in high-rises as landed properties are expensive”.

All 3-bedroom flats saw price increases, with those in Relau achieving the highest growth of 26.09% to RM290,000 from RM230,000 in the previous corresponding quarter. The second highest mover were flats in Bandar Baru Air Itam, which rose 11.11% to RM200,000.

As for the q-o-q performance, flats in Relau again achieved the highest price increase of 11.54%, while the rest saw single-digit growths.

All condos saw price increases as well, with units in Tanjung Tokong rising the most at 29.17% to RM620,000, followed by those in Tanjung Bungah (22.64%) and Pulau Tikus (19.23%).

Q-o-q, all units saw price increases, with condos in Tanjung Bungah (8.33%), Tanjung Tokong (6.9%) and Pulau Tikus (6.9%) being the top three performers.

Meanwhile, the overall rental market saw movements y-o-y, but q-o-q results were mainly unchanged. The rental rates of landed properties experienced more changes than those of high-rises.

Source: TheEdgeMarkets.com

Looks like house prices are still moving up…