Primary, Secondary Or Auctioned Properties: Which Is Worth Buying?

Generally people buy a residential home to live in before moving onto property investments, so for someone who is looking to buy a residential home to live in, what are the options out there?

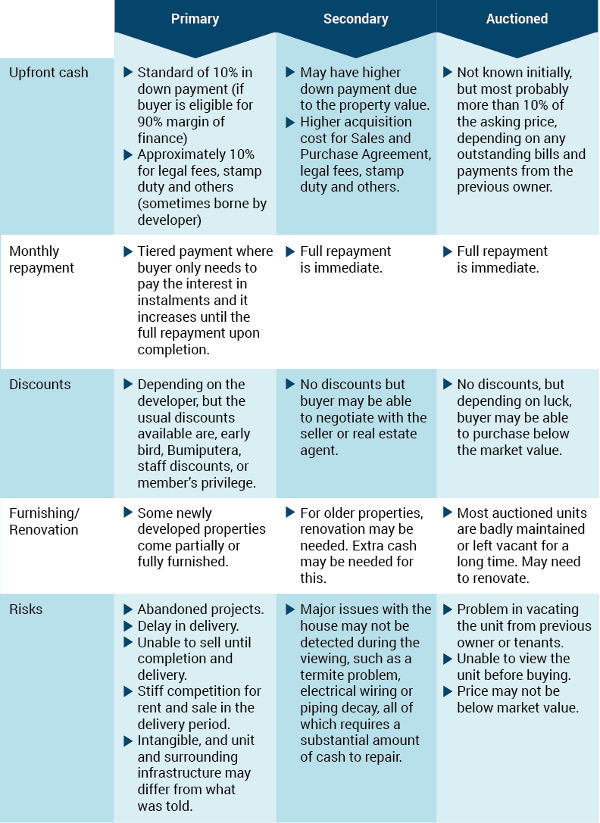

When deciding to buy a house you’ll have to make a decision early on, and that is whether you’re looking to buy a primary, secondary or auctioned property. What do these terms mean?

Buying a primary property means you are buying a brand new property directly from the developer; whereas secondary or sub-sale means you are buying a previously owned property from a private owner and an auctioned property is when a bank sells off a foreclosed property where the previous owner has defaulted on the payment.

So, which type of property stretches your Ringgit the most?

Brand new and shiny

There are advantages and disadvantages in these properties.

What are the advantages for a primary property?

- For a start they are brand new, and therefore less money is required to be spent on renovation and refurbishment, some units even come with basic furnishings such as kitchen cabinets and built-in wardrobes.

- Most units come “guaranteed” meaning there is a period where the developer will address defects on your behalf.

- You get to choose the unit that you want (if available), in other words you can choose your house number, street number, view etc.

- Most importantly you get special discounts when applicable: early bird, Bumiputera, staff discounts or member’s privilege which can shave off quite a substantial amount from the actual price. For example, a 7% Bumiputera discount will translate to RM42,000 saved if you are buying a RM600,000 property.

- You can also get special financing packages from developers in the form of rebates, which can help to reduce the upfront cash needed when buying the property. Other developers may offer furnishings, either fully or partially, so the buyer can save on furnishing cost.

- You only need to pay interest during construction period, this helps in prolonging your full instalments to the bank.

- You get ‘Zero-Down deals’ sometimes through rebates, discounts or sometimes 100% loans, this means no need to come up with immediate cash to purchase the property.

Now let’s look at the disadvantages for a primary property:

- There are some incidences where the projects were abandoned by the developers. This is the greatest risk as you would have lost your deposit and all that you have expended. On top of that you still will not have your property.

- There can be delays on the part of the developer. This would prolong your interest payments to the bank and throw a wrench into your financial plans. This can be painful as you would have to maintain a mortgage without the benefit of the property.

- Another pertinent issue is that the property can’t be sold during the construction period, so you would have to wait it out until keys have been handed over to dispose of it.

- Sometimes the property doesn’t turn out the way it was portrayed in the scale model, brochures or show houses. This can be quite disappointing and if the specifications don’t meet your expectations it can be something you don’t want – and prove difficult to sell of later on.

- With the current prices of materials and other financial uncertainties like the implementation of the goods and services tax (GST) and other new regulations, developers price their properties at future prices now. This means that the actual value of the property could be much lower, resulting in lower than expected appreciation for the buyer by the time the development has been completed.

- Due to the number of new units released to the buyers for certain developments, there may be an oversupply during the delivery period. This makes it tough for owners to sell right after completion or rent out due to the stiff competition.

What you see, you get— a better idea?

As with primary properties buying a sub sale or secondary property has its good points and pitfalls too. Generally secondary properties have lower risk, you can touch and feel and see exactly what you’re getting into. It is right there for you to view, not just the property but the area, the infrastructure, the neighbours, the amenities.

These can immediately be gauged as they are usually located in a matured area, with everything more or less established. At times you can get great value for money deals, good agents can actually show you houses with sometimes up to 30% below market value.

The pitfalls are the most obvious: renovation and repairs. Sometimes you may have to redo whole property’s electrical and plumbing works. Other extensive renovations may be needed if the unit is more than 10 years old or was badly maintained.

There is also a higher acquisition costs: such as the Sale and Purchase Agreement (SPA), loan documentations, and stamp duty among others. It also can be very challenging as you have to find a seller who agrees to sell at the agreed price, which will need three parties to agree mutually, the buyer, the seller and the bank. Once all these are settled you can move in which can take up to a year.

Before you can get your financing approved, banks require the property to be valued by professional valuers, and if the value is lower than the asking price, buyer may need to come up with higher down payment to make up for the shortfall. The home loan’s margin of finance is based on the market value, not the asking price.

More luck than due diligence?

For auctioned properties, luck plays a bigger role. If you are lucky you may get a place that is far below market value and that may be the only way to do so. However, these properties are as is basis, so if it’s a dilapidated old bungalow then that is exactly what you will get.

The upside is, often buyers are able to get their hands on properties in a prime area that are below market price.

However, what you save on the price, you may need to expend on renovation as it usually requires major repairs and renovation as most of these properties are left vacant for some time before the auction. There are also usually unpaid bills, such as utilities, building charges, tax assessments and others. If you are going into buying these properties, you need to prepare at least 30% of the asking price in cash in the event of outstanding bills by previous owner.

Sometimes, the previous owner or his/her tenant may still be occupying the unit and there may be a lengthy process of getting a court order to get them to vacate it.

Auctioned properties really are based on luck at the end of the day.

In a nutshell, these three types of property have their pros and cons. To choose the best one that suit your needs will depend on your risk appetite, financial readiness, needs and opportunities.

Source: iMoney.my