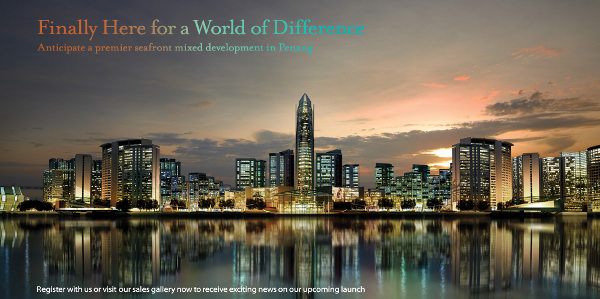

Tropicana Bay Residences @ Penang World City

Bay Residences, the phase 1A of Penang WorldCity development by Tropicana Ivory Sdn. Bhd. Strategically located within Bayan Mutiara, a new development hub located in the eastern part of the Tun Dr Lim Chong Eu Expressway and in the vicinity of Sungai Nibong. Comprises four 22-storey residential tower, with condominium unit size ranging from 455 sq.ft onwards.

Property Project : Tropicana Bay Residences @ Penang World City

Location : Bayan Mutiara, Penang

Property Type : Residential

Land Tenure : Freehold

No. of Blocks : 4 blocks of condominium

No. of Storey : 22

Built-up Area : 455 sq.ft. – 1,945 sq.ft.

Indicative Price: RM359,900 onwards

Developer : Tropicana Ivory Sdn. Bhd.

Register your interest here

Contributed by reader (Update – 02 Oct 2013)

[nggallery id=62]

@Bryant

You can opt to activate it after project completion.

@Jason

Yes..

@islander_ori

It is an option.. will consider that when the time comes.

Seems like RHB is pretty attractive… 90+5%.

anyone already sign the loan offer/agreement?

good. which unit u buy ?

@Bryant

all the package is offer by Bank ….

Now is the RHB offer the better Loan..

How is the RHB 90+5% loan work?

Under DIBS, the developer will cover the interest for 90% loan.

So buyer needs to pay the interest for 5% during construction period?

Anyone have RHB banker contact?

@Jason

1050sqft type..

@isLander_ori i am banker from ambank…wanna try apply our bank package?:)

@islander_ori

HI everyone, i just sign my offer letter with Ocbc Bank, you may call him for detail if u guys need further enquiry from him, Wilson 0164455067.

Penang Guy = Wilson . Got you

OCBC offer me not good the package …

Different Bank different policy.

@Penangguy

What is your package?

@Penangguy

How much is your unit and which type is it?

@Bryant is u get the package as same as stated ?

@cm I think ocbc given a very

good package(self opinion) where u get ur info ? Walk-in to bank ?

@Jason

Just to align, can you tell me the package instead?

I Walk in ….

not like RHB .. AMbank …they can fight for us good rate and 90% up …

@Bryant for house loan it up to 90%, renovation up to 30% , there is other special features that is it not so proper to post it here, if can u can hit me an email, Jasonhorhor@gmail.com.:) i think u better check it out because u have to right get the best deal as a consumer.

@cm Well, no offense, the banker in the bank may be too busy to provide that much infomatiion. why u give it a try for the ocbc mobile agent, they have their own time to provide service to the customer. since u are buying a house and this is not a small amount we talking about. why do u give urself a try to get the best deal for ur own advantage. u may ask me if u interested. As well give me an email. Jasonhorhor@gmail.com.:)

Anyone interested to apply loan can contact me, 0165513468..our rate up to blr-2.45

Thanks

yesterday news again. Seems like PWC project will formally launch on Oct, signing of snp date in this case will be in end of the year of may be next year. Phase 2 is coming!!!

http://www.kwongwah.com.my/news/2013/07/04/116.html

在槟城,玮力产业集团的槟城世界城(PWC)计划,总发展值超过100亿令吉,已经开始获得吸引力。玮力产业集团持有槟城世界城的45%股份,而丽阳机构有限公司(TROP,5401,产业组)则拥有其余股权。

玮力产业集团在槟城世界城的发展值份额为约50亿令吉,相等于其进行中和未来计划整体发展值65亿令吉的逾70%。

该发展商已经看到槟城世界城的购兴增长,后者位于槟岛的巴央珍珠,占地102英亩。刘永福指出,其首阶段面积10.6英亩,发展值7亿6300万令吉的计划,在10月推介之前,已经获得90%的预先注册。

他补充:“这是一个好的开始。我们正计划推出第2期,发展值达13亿令吉,占地13英亩。”

“希望我们可在今年杪之前开始推介第2期。”

Phase 2 is BLK E or other part of PWC area?

Hi, i dont think Block E alone will worth for 1.3 Billion. Must be other new projects. I am not sure how Penangite to swallow all the PWC new projects, with current 0.7 Billion Parcel 1A still have balance (Tropicana Bay Residence) then Parcel 1B the one Asia Green bought over and may launch very soon. Then coming above Ivory new project worth 1.3 Billion. Don’t forget we also have Asia Green new project new QB, ie. Victoria Bay Condo.

Total 4 very big projects.

Can Penangite really can swallow? I dont look good on it

Phase 2 should be the plot behind D’residence, beside the highway

Hi Friends,

I just call Ivory Marketing dept to confirm the panel bank list, but according to her, OCBC seems like is not yet their panel bank yet, for those who apply for OCBC please confirm again.

What i heard she list for me as of today got ambank, HL, standard chartered, citibank etc. But she say OCBC currently still not their panel bank yet.

what about CIMB?

@tomyam

Isn’t it weird? I mean, these bankers will not be able to manage this transaction if they are not panel banks, which I think they are…previously my friend called and confirmed this. Another friend has even signed with OCBC for the loan.

Not sure if it matters to you but effective from today, loan tenure is restricted to 35years.

@Bryant

yeah.. i also feel weird when they say “should be” not yet.. the marketing department people is not doing their job nicely when they use “maybe” and “should be”

i feel regret of not applying the housing loan earlier.. it become 35 years now.. i thought i want to get 38 years loan… the gate of pass the loan is getting higher and higher.. wish me good luck.. i am going to apply 1 or 2 loan in this 2 weeks..then may be when months later.. apply more. Wish me good luck.. haha

i first bank will apply Maybank loan.. actually i like maybank loan concept…semi flexi loan with full flexi facility…withdraw any time without additional charges and no monthly charges.

but heard their loan processing time takes the longer.. so will apply it first.

2nd follow by citibank which i heard some other ivory project.. some people is manage to get -2.5(although not so easy), and its flexi account no monthly charges.. only initial Rm200 setup fee. Now if u ask your friend/partner key in your info in the web, they can even get Rm100 voucher for free to reward the referral person.

3rd i guess is ocbc.. as the branch just 1 road down my house.. they reputation also better than a lot bank.

@tomyam

38 years to 35 years will not increase the monthly installment that much.

For citbank, they offer ~80% loan only as I know.

New rule also caps the total debt to 60% of nett income. Might impact many buyers that yet to apply for loan.

@tomyam

35 and 38yrs loan changes the installment at only RM75 @ BLR-2.4% for a RM500K loan.

So I think it should be fine. But the cap at 60% of nett income will be the killer if you are planning on another property (Are you?). Because I believe you might have other loans like hire purchase and etc..

So, good luck and do not over commit! It will be very painful IF the interest goes up in the future.

@Bryant

Car loan already finish when 2017 (project complete), however, they seems like will not consider it, still taking your full car loan into consideration. Hehe.. this is my first property.. dun have big head to get another property in short term ..

@Bryant

The banker from ocbc actually told me that they consider applicant’s commitments at the point of application. They do not consider when your hire purchase loan ends. But since this will be your first housing loan, nothing to worry about if you still have buffer for the monthly installment

@tomyam

@islander_ori

I just call Citibank officer. They said they will not accept housing loan application for PWC. As currently they no longer accept loan application for DIBS project >_<

I thought IVory marketing dept just told me they are panel bank +__+

Why do they reject loan application for DIBS project ? Does that got to do with the recently announced credit crunch by bank negara ?

Wow, this is kinda shocking.. Wonder why Citibank is having such condition now.. Perhaps other banks will be doing the same thing sooner or later. Better get your loan approved and signed ASAP.. I think rules will be tighter as time flies. Matter of time before 30yrs become maximum loan tenure and etc..

@yeahright

Ocbc is a panel of the project , as i know they provide a special rate for the loan of this pwc, why u give a try for ocbc.

@yeahright

temp is not related with BNM, but is Citibank try to re-positioning their loan i guess..

what he told me is DIBS project and mickey mouse project (those studio n very small sf project) is not in their preferred list. i guess they are doing some risk balancing.

i dunno those who only plan to loan like 70% might have a chance or not.. but with 90% loan on DIBS project is a NONO now.. seems like i need to get in maybank n ocbc faster.. >_<

@tomyam

FYI, I was told every panel banks has a quota given by developer. Once the bank hit the quota, then no more loan application will be accepted. That is why it is advisable to quickly grab the best deal from your preffered bank.

@Bryant

Thanks for the sharing.. I will go and apply now : )

@tomyam Try to get best deal for urself as a buyer. Nothing trouble for have a try.

Try to get best deal for urself as a buyer. Nothing trouble for have a try.

Ocbc is one of the panel banks for this projects for sure. So since u are looking for banks, how about u give ocbc a try . They give a great packages. If interested feel free to drop an email at jasonhorhor@gmail.com. i will explain to u deeply.

@Bryant

Have you sign the loan offer?

@islander_ori

Yup, since may..

@Bryant

ocbc? what rate you manage to get?

which lawyer firm?

Yup, BLR-2.4, San and associates. But you need to ask the banker to get a few quote from CTS and their panel bankers..Then you choose

So, which bank you’ll consider?

@islander_ori

Yup, BLR-2.4, San and associates. But you need to ask the banker to get a few quote from CTS and their panel bankers..Then you choose

So, which bank you’ll consider?

either ocbc or MBB.

@islander_ori I can provide u the service if u ok with it. There is not service charge, why dont u give me a try and i will try to get u the best packages and u can compare it to other after i done the offer letter.

Hi Islander,

I have just submitted one of my customer loan for this project under Hong Leong. It seems that Hong Leong is also a panel bank. Perhaps u could give it a try.

I could help u to submit for Hong Leong together with OCBC. One stone kill 2 birds..;)

Please call me – 0124507531

I would suggest not to go for those “Agency” to “assist” you with multiple loan submission, my experience with them was the rate not necessary good, and they will try to persuade you into buying side products such as insurance.

For loan application, go directly to the banker.

well, im not agree with that, because after all insurance in needed for every loan application right ?banker will not explain to u much because the banker will have their own work in the bank. if u want to ask them to assist u after work i think that is impossible. no offence. mobile agent will have their own time to assistance and explain more detail about how the thing works for the customer advantages.

Jasaon.. I support what u are saying.

Anyhow, when u get ur loan from the banker, u still need to buy insurance as well.. so i would say its the same.

I prepared drop my booking for 615 sf as Victoria Bay is more worth. How do i get back my 10% from the lawyer.

Think you need to inform Ivory.. The can advice you how to proceed from then on.

@SNSD, drop as u wish but go comment at the VB forum, dun throw cold water at the forum here.. Tq!!

代价与报酬而已。

How much is the unit?

You may need to pay 100k more for same size, may be with seasiew.

I was thinking, if what Mah Sing said about sea view units were true on new property, then sea view units will be around RM1000psf.If I could remember, smallest unit is 700sqft. So, starting price is Rm700K.. But we all do not know the package yet. Calculate the worst case as only SPA is free. Remaining shall be Bourne by buyer. Solid 10% dpymt, no DIBS, legal fees and etc. That’s easily RM100k which you still need to wait at least 3yrs to get the key..

All for the sake of sea view.

@Bryant

Hey, Victoria Bay is not from MahSing laaa ….. pls do you home work first before talk here.

1) Read the post “Big plans from southbay city”.

2) I never mentioned Victoria Bay from Mahsing.

3) Then read again my comments.

If still unclear, then too bad.

hi all – i’m trying to applying for the loan now.

for those that have done that, can advice which bank give the best rate and how’s the package looks like?

thanks alot in advance. this can save me some time.

Pls read you comment on #61, no subject, confusing reader. Pls state clearer in future.

Sunny, if its not clear you can just ask me to clarify instead of asking me to do my homework.

Nvm, just ignore my comment in the future. Easier that way..

hi Shirley, u can try RHB…i’m getting BLR -2.4 but with some other benefits.

or any other better from owners here?

Updates from Tropicana corp website

www.tropicanacorp.com.my/ourprojects/future_tropicana_bay_features.php

SPECIAL FEATURES

High rise residences

Pocket parks and lush greenery creates a soothing living environment for the residents

Green belts surrounding the residences separates them from the main streets

Uncompromised view of either the sea or the hills

@Angel thanks ya its right. insurance is needed for all housing loan. the different is the agent may give more explanation and summarize out what is needed for the customer based on his best interest.

ya its right. insurance is needed for all housing loan. the different is the agent may give more explanation and summarize out what is needed for the customer based on his best interest.

@shirlyn_teoh Ocbc is one the panel banks too. It provide a very package too. ( i said it so many times sry for those who seen it :)) u can give it a try, it will cost u nothing for a try. try to get ur best offer.

try to get ur best offer.

btw my email is jasonhorhor@gmail.com. Drop me an email if interested.

i went to pwc show gallery last week and checked the masterplan… found that developments closest to the sea(including reclaim area) are reserved for commercial buildings(no residential).. the closest residential to the sea is tropicana bay residence…. and for that area, the closest residential will be the one that bought by asia green… correct me if i am wrong

Uncompromised view of either the sea or the hills..

How I wish this is totally true.. Think the view applicable on the roof garden is it?

Ambank can offer up to blr-2.45, can contact me at ah_boon7789@hotmail.com or qt 0165513468 thanks@shirlyn_teoh

Hi Ah Boon,

Tentative AM bank maximum loan tenure is 35 years? And you are from which branch?

@Boon7789

can you list down any special condition to get the -2.45? any lock in period or insurance compulsory to purchase?

@Barisucks

hi, what is some other special benefit from RHB? do you mind to share?

Anyone get recent update on the project progress?

Hi kenny, yes maximum 35 years or age 70 whichever earlier..from liang court mobile sales team@Kenny

Hi, no special condition..it depends on management approval..a lot case also can get blr-2.45, but the final decision is at kl management side…lock in will be 3 years from first disbursement…mrta not compulsory@tomyam

@Boon7789

liang court mobiles sales team? is it a standalone housing loan morgages company?

So you are not consider ambank staff right?

Mobile sales team is part of ambank too..liang court is ambank headquarters in penang@tomyam

Anyone know any disadvantages for islamic loan? maybank say islamic loan can offer -2.45.

any their semi package works like full flexi concept.

I heard some other forum complain the number is huge which will be hard for u to perform tracking.

@tomyam

Have you asked about the islamic loan?

Not sure if it applies on home loan islamic loan, for hire purchase islamic loan basically they do not charge interest on default payment. That’s what I know.

@Bryant

i just ask for more detail on islamic loan. So far for Maybank islamic loan is quite nice. (but the rate the banker predict will stick to -2.4 due to my loan amt and this project seldom get -2.45 offer)

Benefit:

no exit penalthy

no lock in period

loan agreement stamp duty discount 20%

can use maybank2you top up any amt any time. * interest deduct with immediate effect.(some bank require you to top up in 1k onwards)

*small disadvantage: till now, cannot use maybanktoyou to withdraw additional payment, must go back home branch to do. conventional loan dun have this problem, so this is the only issue I see.

the officer say their online system already in 3rd version, so buyer can see the

total amt still owe (principle + loan interest) and another principle owe only. should not an issue.

so i am still thinking taking conventional or islamic loan.

conventional have lock in period 4 years, no discount on the stamp duty (discount about Rm500) but withdraw can be done through maybank2you any time n day. is very convinience. (as it is semi-flexi, so no monthly fee)

it also no min requirement if fully settle account (as long not close account)

btw, the officer say all bank penalthy of late payment grace period is very different. so far maybank offer is one of the best. given 2 weeks will not fine. some bank only allow 1 week.

if consecutive 3 months did not pay, then blr rate will become blr + 2.5 = 9.1% (pls take note on this) he say can ask other bank, a lot of bank is having more hidden rules for the criteria.

anyone can share the detail of other req/criteria of the loan other than the interest rate offer?

i am still seeking which bank can offer me -2.45 without any special condition.

@tomyam

Thanks for sharing..Islamic loan looks good.

But you mentioned loan agreement stamp duty has 20% discount?

Do you mean the loan legal fee instead? stamp duty normally no discount.

If its legal fee, then the discount % really depends on different quatation from different lawyer.

Try ambank, as stated above there are possibility to get -2.45%. No harm trying.

@Bryant

he wrote in the paper is loan agreement stamp duty.and the example he gv below.

general fees need to pay is (this is the general formula calculation for them for easy calculate)

loan amt X 1.2% = yyy amt

55% of yyy = laywer fee

40% of yyy = loan agreement stamp duty (20% from here will be waive)

5% is misc

@Bryant

i only dislike islamic loan while need withdrawal, need to go home bank. although he mention “maybe” future can withdraw online like conventional loan as well.. coz the system is not yet develop yet.. haha.. the may be dunno how long ler..

ok.. i guess i will try ambank as well.

@tomyam

Hey, 55% lawyer fee normally will have discount. Remember to nego for that if possible.

So the 20% discount for stamp duty will save you a few hundred bucks..that is good.

Anyway, the OCBC loan I took do have the capital acccount where the top up amount will be considered as principal reduction immediately thus interest is lesser. But to top up or withdraw from that account, I have to personally go to the bank to do so. Each withdrawal cost RM50 with minimum withdrawal of RM1K (If I remember correctly).

@Bryant

Ya.. i know the lawyer fee will be different, I plan to ask the banker to help me to get the offer for different lawyer in their panel bank when i decide which offer i take.

how is the nego process take place? you call the lawyer firm yourself to ask for discount or the banker will help you for this?

ya.. the 20 % discount will be about Rm500 to Rm600 .. but i am still considering getting the conventional bank offer.. at least future top up or withdrawal can be done anytime.. each withdrwal cost RM25. ocbc one seems quite high.. but it have the reputation.

The bankers can get the quotation with discount for you but you still need to call the lawyer firm to the get the further discount.

@tomyam

As what islander_ori said, you can call up and ask as well.

@islander_ori

You got your loan already?

@Bryant

yup, mbb, just for convinience.

Yes, no harm trying..if any of you interested for ambank loan, can drop me an email at ah_boon7789@hotmail.com thanks@Bryant

@Boon7789

what is your hp no?

Just curious..

the booking receipt or downpayment reciept of you all

the project name is write PWC or Tropicana Bay Residences

my HL/OCBC agent calling me asking me who is the sales person of the project i work with so he can ask them gv a letter to clarify PWC = Tropicana Bay Residence.

next time.. may be we should only find the bank agent who’s name card is get from the ivory office.. else sure got communication break down.

@tomyam

It is written “Penang World City Phase 1a”… I think back in february, TBR is not officially announced yet.

I deal directly with the OCBC bank officer.

But I did not encounter such problem. Normally they are more then capable to find out this information by themselves as they are the panel banks.

Not sure about agent status..maybe they work differently.

@Bryant

Ya.. actually he have the bank name card but consider not their employee.. just those standalone one. I ask him direct call ivory marketing dept to check it out. haha..

I am not sure whether it is ocbc or hl is asking this.. coz he help me apply both bank at same time. So far did not encounter this issue with Maybank agent.

**btw, i also heard my colleague with maybank loan, he said every year he need to go home office and submit the fire insurance(for condo), they not allow him to send/mail the receipt to the bank but must go the office personally. If they condo management slow motion issue the receipt , the bank very fast will auto help you buy the fire insurance, and the refund process is quite pain as the counter service there is extreme slow.

Can anyone please provide me any lawyer firm who gave reasonable quotes. Thanks.

hv any of u receive call from the lawyers office that stamping will be done by end august?

They are dragging it till next year. The slower the better.

Kebenaran merancang (KM) already being approved months ago. They have also just submitted the Pelan Bangunan (PB), normally will take 1 – 2 months if no delay. Once PB is approved, there is no holding back, this project can just go full swing.

Tropicana Ivory is in no position to delay this project, they need the cash flow fast. If they delay the snp stamping they wont be able to disburse from bank, its a lose-lose situation.

Those who had booked were given till end of the year to apply for their

loans. I don’t see any swing only full swing in delay.

I booked a unit in kl. Car park is mentioned in Deed of Mutual Covenant. Also, the deed mentions that the car park belongs to vendor ie tropicana. This seems contradicts what I have been told by sales, did I miss something here or this is a lie?

The car park belong to Tropicana.

Each unit will have minimum 1 car park no matter what.

Unless you want to sell your car park to your neighbour.

I asked about buying additional car park and I was told upon O.C only the additional car park will be open for sale. Now I am confused because the deed mentioned above, car park belongs to a tropicana. So, the additional purchased car park has to be own to buyer right? That means our current purchase price officially for the unit only. NO car park..super crazy.. Anyone knows why such arrangement is happening?

I think those who bought in KL would have seen deed of mutual covenant and clearly say developer own the carpark and buyer get to use it. . and possibly buyer in penang may not have seen this doc. .

@pwc

is it stated in SPA?

Hi..

Is this project residential title or commercial title?

Thks

I asked about buying additional car park and I was told upon O.C only the additional car park will be open for sale. Now I am confused because the deed mentioned above, car park belongs to tropicana. So, the additional purchased car park has to be own to buyer right? That means our current purchase price officially for the unit only. NO car park..super crazy.. Anyone knows why such arrangement is happening?

In KL we have signed SnP and deed of mutual covenant. Carpark was not mentioned in SnP but in the deed. .

buyers in penang have not signed these 2 doc? Lawyer in kl made it a point to explain that car park is owned by developer

In the deed itself, it says very clearly that the car park belongs to Tropicana and it is up to the company’s discretion to apply for us to form as part of accessory parcel. I raised this point because I do not expect such a clause to be mentioned in the deed and that I will be a owner of the car park. There seems to be no room for me to trust that this is the case by reading the deed. Who knows they want to charge us for it later.

I had asked my sales rep to come up with a letter to clarify such matter and forbids the company from charging us in the future. I will likely ask them to apply the car park as forming part of accessory parcel too without any further cost to me.

I am just sharing what I have read and I believe if buyers collectively start to knock the company harder may be they will change their ways of doing things.

@Bryant

You bought in Penang right? I dun think I sign that during the pre-snp and lawyer did not mention to me in this.

I wonder if the car park owner belong to developer and we entitle allocation for 1 car park, did they have the right to charge us in future? can we request they come up a formal letter that we can use the car park for free forever and if we sell it in future, the new owner will also entitle the same?

or else we might have serious problem when one day business very good, they start charges us Rm200 per car park per month. I think i read a similar news yesterday on this.

@tomyam

SPA did not mentioned that.

You can request to SPA copy from CTS.

@tomyam

I bought it in Penang. As I was told every unit entitled for 1 car park and bigger units have 2 car parks. The pre-s&p were almost blank, not much information at all.

I have a feeling that Tropicana plans to make some money out of the carparks, be it rental or sale. Maybe 1st owner entitled to a parking lot for free. But subsequent owner no longer entitled to the same lot anymore, need to pay.

@Johnny

What was the outcome of your request?

My request is still pending as the sales rep is on leave. Don’t have to wait for me. Don’t be fool by what the developer says, get it black and white. I don’t intend to pay extra money for the car park. If we are given car park as what they claimed, what’s so hard to come up with a letter saying so. Do you agree?

Btw, how’s the sales? Anyone dropped by the sales office recently?

Johnny, I am thinking that this type of black and white “letter” may end up useless and whatever stated in S&P, DMC and etc is always the winner and the final thing. I intend to get another car park if possible so definitely this additional car park belongs to me, not tropicana!

i have come across a few owners cancel their booking, get prepare for plenty of unsold units

Boils down to trust since they are not willing to come up with letter.

Said that they will apply with authorities to make car park as accessory parcel and then up to authorities whether they allocate car park to owner.

Hard to understand what that means. Is there any clause inside DMC to say that we can use the car park irrespective of the outcome by the authorities?

Something is misleading here ? If car parking lots are not provided, how

are they going to get the authority’s approval ?

Under most cases, car park slots are considered as accessery parcels. Which means the developer can sell their units without a car park practically, just like what happen to some of the LMC. However in this case, since the developer has already stated the number of car park allocated clearly to the buyer, I don’t think they gonna get away from this by just do some dirty tricks, it wont work this way. Dun forget by law, verbal commitment also binded as contractual term.

The Minister of Housing and Local Government in his wisdom in 2007

amended Regulation 6 of the Housing Development (Control and Licensing)

Regulation 1989 to further protect house purchasers in regards to car park

bays. It is now compulsory for every housing advertisement to state the

following:

“(ea) any parking lot which is an accessory parcel to the housing

accommodation in a parcel and which does not form part of the common

property of the accommodation”.

A perusal of housing advertisements in newspapers would clearly reveal that

most developers are blatantly omitting this particular piece of information in

their advertisements.

In other words, a housing advertisement must state clearly how many car

park lots (accessory parcel) are to be included in the sale of the particular

housing accommodation.

Additionally, a developer must also decide at the point of sale whether they

want to sell the car parks or keep them for themselves. They cannot keep the

car parks for themselves at the point of sale and then later try to sell the car

parks separately.

@tomyam actually only cost 10 per transaction, ocbc is on of the panel bank. i had done few cases from this project. since u are trying why don try for ocbc as well. ocbc has the features than other bank do not have with the loan. drop me an email at jasonhorhor@gmail.com:) u can let the loan park at any branch u want that easy for u.

anyway i had read what u had mention about the benefits of other bank that u know. It is almost the same with ocbc can provide.

@Jason

Hi Jason,

Thanks, the first 2 Bank i apply is with OCBC/HLB.

Anyway, do you mind to share the grace period for late payment for OCBC as i guess i not ask OCBC this question. If there is any extra benefit I miss out for OCBC loan, may be you can highlight here so those who interested can contact you as well. Actually I quite like OCBC for its fast processing , security and services, just that its online services flexibility still not that flexi.

If i get all the bank loan approved with same rate, I might still consider Maybank as my first priority due to the online flexibility.

Understand from Maybank banker, I can withdraw through maybank2you anytime and no need to inform in advance, and it can be done online. (withdraw cost slighly higher which is RM25) – It is very unconvinience for me to go bank anymore due to my work type and nature.

They also having a longer grace period, if you get delay to pay even 1 week, you still wont direct hit the late payment charges.

If you have the 100% cash, you can all put in the account without any penalthy. (OK, this should not a really usefull benefit as most people does not.. but benefit is still benefit.. haha.. who knows one day i kena lottery can park there but dun want to settle the loan yet)

**By the way, yesterday i called CTS and the girl told me better fast fast apply loan as from what she know.. the final snp date could be earlier from what she heard from ivory.

Spoken with the PIC for PWC at tropicana this afternoon who said the developer would apply car park as accessory parcel for buyer and car park will be given to us. I rest my case and proceed.

So we just wait for the final DMC and S&P to see if this matter has been addressed accordingly.

@Bryant

No. DMC has stated what I mentioned in forum. Just have to rely on trust on developer to really deliver car park to us. Best if you talk to someone senior from sales and marketing to show that we are serious and we rely on their verbal representation.

For all Penang buyers,

Please get the Full Schedule H and Deed of Mutual Agreement Copy from developer/lawyer now.

I have ask the copy from CTS lawyer firm for soft copy and now only i know what KL buyer are talking about. I do not know what is your experience when doing the pre-snp but for my case, that day the laywer is actually go through with me a very general 5 minutes on telling me the allocation of 1 car park n how is the billing method and the DIBS package they covered.

After now i print out all the docs from CTS, I notice at that day we are making 2 signature one is on the deed and another is schedule H. Now all our floor plan and facility etc is all printed clearly there ( i guess i need to start digest on what it say). So please take a look on it and get it from cts if you still do not have one.

** those extra pages only print out after project is name so we wont see it while we sign

i got the email from ivory on car park answer as below: (If not mistaken, the transfer of the car park to title will cost Rm500 to Rm600 each.)

Please be informed that the allocated carpark or purchased lot will be accessorize in the Property title in the day the strata title issued, it will be belongs to the unit owner. We might have car park lots for sale later when we have confirmed all allocated lots and the balance will release for sale. At the time being, we are not selling as we have yet to stamp the agreement. We will keep you informed if the lots are open for sale which is subject to our management’s decision.

@tomyam

I requested a copy the SPA (without stamp) from CTS but no Deed of Mutual Agreement Copy.

@tomyam

CTS sent the softcopy of the S&P and DMC to you? Did you call them or send them e-mail for the softcopy request?

@Bryant

After i saw the discussion here, I call CTS to send me softcopy for all related docs that already have.

They send me 2 copy.

One is SNP (schedule H) which consist of 21 page.

2nd is Deed of Mutual Convenants which consist of 37 page.

@islander_ori

May be need to purposely clearly state you need that document too. Coz i tell them i want to more clear on what I sign. ** I just call 2 days ago, the email just arrive today.

So, it is clear. At the moment:

Car park belongs to the vendor (Tropicana Ivory).

Every unit will be allocated parking lot(s) for usage.

Vendor can choose to give you the car park in the end or keep it for other use.

Purchaser shall have no right to claim over this matter.

At the same time, I received information from the lawyer through tropicana GM (sales team) regarding the car park concern and as what Tomyam said:

“Please be informed that the allocated carpark or purchased lot will be accessorize in the Property title in the day the strata title issued, it will be belongs to the unit owner. ”

Then of course, terms and condition applies and all subject to management decision! Nothing is confirmed as black and white stated otherwise NOW!

Hi… Anyone know if this project is residencial title or commercial title?

TBR is residential.

@tomyam Hi. ok. For the ocbc grace period it is 14days. for the cash withdraw issue, since ocbc is having semi- flexi loan, u may have to go to bank for withdraw and the benefit is there is no maintenance fees. those banks with flexi loan u might have to pay rm10 maintenance fees for every month even u did not have transaction. u only have to pay for the processing fees for rm10 each time with semi flexi loan. u can put a large amount of cash in the loan to avoid interest too with semi- flexi and u can withdraw anytime u want. unlimited withdraw. it still got other features there is not suitable to posted here. anything can drop me an email at jsonhorhor@gmail.com. also for those who looking for loan and any other question. thanks. do u have any idea when is the last date for signing snp

do u have any idea when is the last date for signing snp

Comrades,

A source was telling me that developer target to stamp the spa end of august. If that is true, you guys better get your loan ready… Anyone else have other information on this topic?

@Bryant is that true ? official ?

@Steven

I heard DIBS package must take back CTS.. not sure how true is it..

already discount quote than CTS.. still slightly higher few hundred bucks than outside one.

I need to read the detail for the doc I sign first for this.. see whether they got state anything rules for this.

@Bryant

CTS Miss Lim keep on ask me fast fast get loan.. should be soon.. hmmm..

really so fast???

They are trying to prevent those had booked from returning back their units.

@Jason

Not official. Only verbal information.

@tomyam

Don’t know fast or not but whatever it is, better stamp fast.

If they stamp in September ’13, then February ’17 is VP!

After stamp I will be waiting a maximum of 42months for my key

If not, buyers will be compensated for the delay.

@tomyam

For DIBS, you need to select panel bank approved by developer.

But the lawyer for loan agreement can be from the panel lawyers approved by the particular bank.

What are the units available, anyone can update? Selling prices?

Block A & B was launched at RM ??? PSF,

Block C & D was launched at RM ??? PSF, % increase / RM ??? increase?

Estimated Block E launching date? Expected price PSF?

Felicia, it would be better for yourself to drop by and find out. I drop by the sales gallery today and the sales chart shows availability for smallest and biggest unit in blk A,B and C only. I did not see the price. Blk E will launch in Sept. that is why stamping will take place this month as i was told today. You can expect higher psf for Blk E..

@Bryant

For block E, previously there were 50+ units of 455sf studio planned. . is it still valid? Anyway still many studios in block A? Thanks

I find the PSF pricing a little weird for this Penang Workd City

455 SF unit at RM900psf onwards

615 SF unit at RM820psf onwards

871 SF unit at RM700psf onwards

The above is recent prices, I presumed it was at least 15 to 20% lower for Block A& B when it was launched in Feb 2013.

I personally feel for flip purpose, 872 SF units stand a better bet compared to smaller size units

For those who has committed, care to tell us the unit size you purchased and the PSF price?

Need this information to prepare for Block E & Block F launching

Anyone has information on the 4 blocks of condominium directly infront of Block E & F that does not come under this project?

Such as,

1) How many units,

2) height, how many level,

3) Their orientations, are they blocking the view of Penang WorldCity phase 1A?

4) Whar price were they selling?

5) total area for these 2 parcel if development? Close to 900 units for Block A,B,C & D, plus Block E & F, There will be total of 1200 to 1300 units for Penang World City, plus 4 blocks from other developer, total of more than 2000 units in ?? Acres of land, would this place be very high density?

6) will there be pedestrian walk way to the seafront? As can be seen from the plan, it is surrounded by dual lanes roads.

Pen-condo, If you really gonna invest, better get the first hand information yourself from the developer. Just an advice, talk to someone who has worked with ivory for a long time. There are ivory staff who knows nothing and simply answer your question.

I took 872 sf unit.

By looking at the picture in the agreement, it is a 9000 X 9000 or build up area of 81 square meter.

How it ties to 872 sf? 872 – 810 = 62 meter goes to where?

You just have to get your math right: 81 square meter = 872 square feet, so nothing wrong.

@BP

If they are blur-blur, how to ask? I will get blur-blur answers and make me more confuse

@tomyam

Wise decision.

What price you pay?

PSF work out to be RM??? PSF??

@BP

Any recommendation of whom to talk to?

Anyone care to shed some light?

Before election, Malaysia currency was string against major current BUT now appear to be weak;

RM / USD. Before 3.03. Now 3.25

RM / SGD Before 2.43, Now 2.58

RM / £. Before 4.80, Now 5.04

Does it mean Malaysia economy is deteriorating?

@tomyam

Do you want to sell?

@Pen-Condo

I was told that Blk E will be opened for sales in sept, right after the stamping of current sales of Blk A,B,C and D. If you need more details maybe you can ask the sales person at the office itself. They have more updated information. Or just simply wait for the sales in sept. On paper, prices has increased 30 to 50k since the launch in feb. Blk E can expect higher psf pricing then.

@Bryant

Meaning the current price for Block C & D is easily RM30 to RM50k higher than Block A & B?

In your analysis, what size is a better but or rather value for money buy disregards affordability issue.

From the comments in this website, understand 455 SF units are the most expensive in term of PSF follow by 615 SF. However, 872 SF units appears to be the cheapest in term of PSF, correct?

@Pen-Condo

The price I bought already slightly higher which is >700 psf. The cheapest should be 1st phase buyer who buy Block A and Block B.

The cheapest in terms of sf should be those 1xxx sf price. The largest the unit, the avg price is lower.

My personal opinion of Malaysia currency is , Yes, Malaysia dollar getting weaker compare to most currency. Inflation is up gradually but you still can feel is, at least the hawker center price here getting up. I personally feel the price of this project is setting quite high. But if all inflation coming up, 4 years later. Nothing is” reasonable”.

@ffg

opps.. paiseh.. i guess i am totally too weak in those conversion stuff..

@tomyam

What is the price of 10xx SF in term of PSF??

@Pen-Condo

As what tomyam mentioned, the bigger the unit the lower the psf.

Of course for “cheap and big” then the biggest unit will be value for money as you are paying lesser for every sqft (disregard affordability or other issue).

But the sales chart only have the smallest (455 and 615sqft) and biggest (1320sqft).

Those in the more popular range like 872, 1020 sqft snapped up!

(Information as of 10th august)

Then it all goes back to affordability in future for subsale in case of investment.

Current psf is about RM700. In 2017, can one sell @ RM900psf or ambitiously at RM1200psf?

That would be RM785K to RM1.05M for 872sqft and RM920K to Rm1.22M for 1020 sqft.

How many in Penang can afford that? A 2 generation loan will be needed!

But hey, if buy smaller units, then it is cheaper which will be within reach.

So you decide. But if for own stay, then don’t have to think about subsale issue at all

@Pen-Condo

As what tomyam mentioned, the bigger the unit the lower the psf.

Of course for “cheap and big” then the biggest unit will be value for money as you are paying lesser for every sqft (disregard affordability or other issue).

But the sales chart only have the smallest (455 and 615sqft) and biggest (1320sqft).

Those in the more popular range like 872, 1020 sqft snapped up!

(Information as of 10th august)

Then it all goes back to affordability in future for subsale in case of investment.

Current psf is about RM700. In 2017, can one sell @ RM900psf or ambitiously at RM1200psf?

That would be RM785K to RM1.05M for 872sqft and RM920K to Rm1.22M for 1020 sqft.

How many in Penang can afford that? A 2 generation loan will be needed!

But hey, if buy smaller units, then it is cheaper which will be within reach.

So you decide. But if for own stay, then don’t have to think about subsale issue at all.

From my record, starting from RM630psf (after discount and rebate) for 1020sqft..but I believe it is even lower for those people who manage to get it from insiders prior to launch..

218macalister will be 900psf onwards after rebate.. which is better location?

@ pwc,

Both 218 and TBR location has their own winning points. Really depends on preference although there are many other factors which determines the selling price psf. City Center vs seafront units. Definitely city center location means much more convinience to everywhere but constant traffic jam is inevitable. I am actually interested in 218 as well..but mainly due to its location and rental opportunity. Smallest 374sqft @ RM340K, if tropicana can manage the rental, then it is even better. @ RM900psf, it is slightly more expensive then TBR 455sqft which is around RM750 to 850psf.

Are you buying?

@Bryant

Actually i just wonder.. if all people theory, future launch phase will be expensive than current phase.. those real sea view unit for pwc will be how much..(especially the advertisement , got 1 building like half circle welcoming hug type) could it be in future all seaview unit > 1 million

@tomyam

It is true that future launches is more pricy then current launch. Else the initial buyer like you and me gonna be dissatisfied. Imagine BLK E psf pricing is RM50 to RM100 lower on average, I am sure many will let go of their current unit in A,B,C and D.

The loft already selling at RM900psf, with more then RM1M price tag for their smallest unit.

So if smallest unit for future launch gets smaller, maybe have chance seaview unit still less than 1M.

You know that front plot of PWC land which AG purchased for their seaview condo? Salesman told me that it will be two more years before AG will launch it. Apparently, Tropicana Ivory is delaying AG plan approval process because AG needs to go through Tropicana Ivory to get their plans approved. By doing so, somehow Ivory gets to protect their interest in their future launches. Unsure how true is this, but that seaview units from AG will be pricy two years from now!

If this is true, then bad news to those who let go of their TBR units in order to wait for the seaview units by AG.

Pricing disparity on PSF basis between big size unit and small size unit is just too wide, unbelievable especially when both types are having same number of car park. PSF basis, difference of RM120 to RM 200 is just too much. Anyway, is developer call, their right.

Future phase definitely will be priced higher. Should developer launch similar sizes, the 872 SF even up RM 30 PSF is still reasonable compared to 615 SF & 455 SF units. The 1020 SF unit at below RM700 PSF is even better overall.

@Bryant

Still can let go??

Heard some let go.. Don’t know if they did let go..

@Bryant

I mean still can let go after signing S&P? Any penalty?

The other issue is congestion, Penangites, what do you guys think especially with so many new development around these area.

@Pen-Condo

S&P signed but not stamped. Details of letting go, I am not sure.

Salesperson should know better.

That Pre-sign SnP is not legally bind. You can let go any time with getting full re-fund.

Talk to the lawyer for more detail.

@Bryant

When would the S&P be stamped?

What are the incentives coming with these purchase?

Understand developer is splitting the block E to 2 parcels; Block E & Block F. Similarly, collect booking fee only?

The 4 blocks infront of Block E is developed by PDC, anyone knows of their selling prices?

What about the prices of the vicinity condominium? Anyone care to share?

@Pen-Condo

congestion is an issue.. but i feel like kinda no choice.

good location with no congestion issue always come with sky high housing price.. as that area with be more to terrace house or bungalow..

now all apartment coming up in all the place. i guess go to which new property forum in penang island always see common issue bring up below

1) congestion

2) mosque volume

3) developer issue

4) high price

5) too far from city/working area

I think the PWC location is not too bad..took me 10mins to reach town. 3mins to enter pg bridge. Distance to factories area also quite nearby. During peak hour, surely take longer time. Everywhere also congested. Pretty standard way of situation almost everywhere.

Pen-Condo, I was told stamping this month.

Incentives? So far every room will be fitted with air cond. Other then rebates and discounts, the rest is about the same.

4 blocks in front of BLK E bought by AG. Selling price unknown. Expect much higher then BLK E or F. Just imagine RM1K or more psf. If cheaper then good! If not, then expected.

@Bryant

Someone informed that the 4 blocks infront were sold at much lower price than Block A

& Block B. I was asking about the height issue by the front 4 blocks by other developer but unable to get answer.

@Bryant

The only incentive is air-cond??!! besides 3% discount & 5% rebate. It work out 1020 SF and 872 SF units are the best but. 1020 SF unit comes with 1 car park or 2 car parks?

Comparing this PWC versus the coming 218 Macalister, which is a better bet?

@Pen-Condo

1020sqft comes with 1 car park. Forgot to mentioned, DIBS included in sales package too.

If you are planning to buy, not much units left. 872 and 1020 no more unless have units with loans rejected.

If the 4 blocks selling at cheaper price, I might consider getting another unit with seaview! But seriously, unlikely cheaper except for bad units with bad facing, low floor and etc (still unlikely).. Just my opinion though.

Depending on 218 sales package.. Would you invest on the smallest unit at 374sqft if selling at RM1200 to RM1500psf? If money is no concern, bet both! If not, good luck in your decision!

1020SF comes with 1 car park & better is 1320SF with 2 car park and 2 balcony!maid room with toilet.

@HK

I wonder how many bought for flip purpose and how many bought for own use?

Is commonly seen many condominiums after 3 years are still very empty!!

@Bryant

I just notice your previous post mention OCBC withdrawel cost RM50.. but my ocbc banker say only RM10 ler..

Anyone have relatives/friends take Ambank housing loan before? as heard they can offer up to -2.45 but i really need to see whether any one take it b4.

Rarely heard any friends taking ambank housing loan as i would like to get any positive/negative feedback.

For maybank islamic loan sounds good, but got a lot people ask me to be cautions on islamic tnc which normally those banker will not tell u if u not ask. hmmm..

sometimes those tnc will only write it clear in the final doc u sign.

SAN & ASSOCIATES is one of the OCBC panel bank? Ivory keep on hard promote CTS, i still wonder if take other lawyer firm although might be cheaper few hundred bucks , but will there any “intentional” delay of process which in the end lead to we need to pay those late penalthy etc.

@tomyam

I was not sure about the withdrawal fee. That is why i mentioned “If I remember correctly”.

Anyway, RM10 is good!

I switched from SAN and Assc back to CTS for the legal loan. CTS counter offered cheaper legal cost after knowing how much SAN offered. I see no problem in my decision as the same lawyer (CTS) will be handling all the legal matters pertaining to my unit purchased. Easier for me too.

@Pen-Condo

1020sqft comes with 1 car park. Forgot to mentioned, DIBS included in sales package too.

If you are planning to buy, not much units left. 872 and 1020 no more unless have units with loans rejected.

If the 4 blocks selling at cheaper price, I might consider getting another unit with seaview! But seriously, unlikely cheaper except for bad units with bad facing, low floor and etc (still unlikely).. Just my opinion though.

Depending on 218 sales package.. Would you invest on the smallest unit at 374sqft if selling at RM1200 to RM1500psf? If money is no concern, bet both! If not, good luck in your decision!

@Bryant

Are you call back to CTS to nego again for the legal cost and gv them the SAN quote?

I just get my banker help to get the quote, notice those non CTS/SAN quote me cheaper near to 2k in the total fees(stamp duty + legal fee)

Give an example: loan amount 600000, CTS after discount still 8k++ but the lawyer firm banker able help me to get only 6k++

(but i really can’t believe the difference can be up to 2k.. )

@tomyam

Initially I ask banker to get me the quote. Then I called up CTS about the S&P,DOMC and DIBS document at the same time CTS asked me about the loan thingy and that is where the discussion came up about the legal loan preference. So I mentioned SAN quote me cheaper, then CTS counter quote slightly cheaper for me.

After checking with SAN that there is no paper fee (in case they started working), where there is non, so I switched back to CTS. Easier also to have all under one lawyer. But if its 2K diff for you, better go to that non SAN/CTS lawyer. Unless CTS can quote you cheaper then 2K.

@Bryant

Haha.. like that i no harm trying call back CTS too check whether they can gv me the better offer or not 😛

I also feel all manage by same lawyer is better.. but the process to get best quote is hard.

May be my nego skill not so good +_+

@Bryant

Should there be loan rejection, should know by now, right? I visited the sales office, unfortunately there isn’t any 872 or 1020 SF units left except few 615 and 455 which I am not keen at all after comparing the RM/SF price. That means my chance of acquiring 1 unit at PWC is slim unless I go for Block E, provided the RM/SF price is reasonable, otherwise forget it, rather let others chase after their dreams. Market now has plenty of options.

As for 218 Macalister, was told price will be RM1000 PSF onwards but comes with fitting, etc…not sure what is right, need to wait. 218 might have a better chance of renting out as is in CBD area plus it has 208 hotel rooms, etc. My opinion.

@Pen-Condo

In your opinon, how much RM/SF is reasonable? Did you ask the sales people what is estimated psf pricing for BLK E?

Apparently, during the start of the booking, we were told that loan application comes much later so I think many people were taking their sweet time to get it process. Soon you will see the results. Anyway, for those units with loan rejected, bear in mind the prices has increased 30 to 50K from its initial list price.

Keep us updated if you were informed of the 218 launch. Interested to know as well.

According to Dijaya kl, the indicative price for 218 is 1050psf before 10% rebate.

I believe when they launch block E price will be higher than existing balance units.. hence some buyers will still buy block a-d.. this is the usual developer approach. They are in no hurry to sell off balance units

Most of the new project launch in Penang exceed above 1k per sq ft, Penang Island ppl very rich for sure will sapu all the units,

@pwc

If 10% rebate can be use to offset the dpymt, then 218 is really a low entry/easy own scheme! the psf will be lower after the 10% rebate. If developer furnished the units as well with management or hotel mgt for the unit for rental, then surely will sold out.